10 Powerful Insights: OEM vs Third-Party Maintenance Explained for Smarter Equipment Management

In modern construction, the choice between OEM vs third-party maintenance can significantly impact a company’s operational efficiency and bottom line. Behind every smoothly running excavator, grader, or tower crane lies a critical decision: whether to rely on original manufacturer servicing or independent maintenance providers. Understanding this balance is crucial for more effective and cost-efficient equipment management.

Understanding OEM vs Third-Party Maintenance

In the construction industry, equipment uptime determines project profitability. Delays caused by machinery breakdowns can derail timelines, inflate costs, and compromise safety. That’s why equipment servicing strategies are not just about fixing problems; they’re about preventing them through thoughtful maintenance planning.

At the heart of modern maintenance planning lies the debate between OEM vs third-party maintenance. Both offer distinct advantages, but they differ in scope, flexibility, and cost structure. Original Equipment Manufacturer (OEM) maintenance focuses on standardisation, warranty protection, and certified expertise, while third-party providers emphasise adaptability, affordability, and customised support.

Choosing the right option depends on a contractor’s priorities, whether it’s maintaining brand compliance, achieving faster turnaround, or lowering operational costs.

What Is OEM Maintenance?

Original Equipment Manufacturer (OEM) maintenance refers to services provided directly by the equipment manufacturer or its authorised dealers. These maintenance programs are built on factory-grade precision, certified technicians, and genuine parts replacement.

Key Features of OEM Maintenance:

- Use of original spare parts meeting factory specifications.

- Scheduled servicing based on manufacturer-recommended intervals.

- Diagnostic tools are directly linked to the equipment’s software and sensors.

- Extended warranties and service contracts covering high-value assets.

- Compliance with international safety and emissions standards.

For large construction firms running modern fleets, OEM support ensures uniformity and traceability. It’s especially valuable for equipment under warranty or in regulated environments requiring certified service documentation.

Example:

A contractor operating Caterpillar excavators under warranty may prefer OEM servicing because it guarantees genuine parts and specialised diagnostic software updates that third-party providers might not have have access to to. They will also appreciate this method because it alleviates the burden associated with scheduling, sourcing, procuring, and shipping spare parts from the manufacturer.

What Is Third-Party Maintenance?

Third-party maintenance (TPM), in contrast, is performed by independent service providers operating outside the OEM network. These firms often offer multi-brand expertise, lower service costs, and greater flexibility, which are critical advantages for contractors managing diverse fleets, operating old equipment with no warranty, or working on a tight budget.

Key Features of Third-Party Maintenance:

- Lower servicing costs (typically 20–40% cheaper than OEM rates).

- Multi-equipment expertise (across brands like Komatsu, Volvo, or JCB).

- Customised maintenance schedules tailored to site conditions.

- Freedom from OEM contract restrictions or warranty limitations (after expiry).

- Use of high-quality aftermarket or remanufactured parts.

Independent providers often employ skilled engineers with extensive industry experience, enabling them to offer on-site repairs more quickly and cost-effectively than OEM field teams.

Example:

A contractor operating a fleet of second-hand equipment will mostly rely on aftermarket spare parts to service their equipment, due to their lower capital investment and cost-cutting measures. Some contractors might be fully established but operate a fleet of multi-brand equipment that cannot be serviced at an OEM facility. They do this using a contracted mechanic’s workshop or by utilising their own established repair centres.

10 Powerful Insights: OEM vs Third-Party Maintenance Comparison Guide

To make the right choice, contractors must understand the trade-offs. Below is a detailed comparison of OEM (Original Equipment Manufacturer) vs. third-party maintenance, highlighting how each option affects cost, reliability, and long-term performance.

This breakdown demonstrates that the key differences between OEM and third-party maintenance are strategic rather than purely technical. The choice depends on a contractor’s operating model, budget, and risk tolerance.

Insight 1: Total Cost of Ownership Is the True Measure

Before choosing between OEM maintenance vs third-party support, look beyond sticker prices. Total cost of ownership (TCO) includes:

- Acquisition and financing.

- Scheduled maintenance costs.

- Downtime penalties and hire costs for replacements.

- Residual value at resale.

OEM contracts often carry premium labour and spare-part prices, but they can preserve resale value and reduce unexpected failures during the warranty period. Third-party maintenance typically lowers direct servicing expense, yet can increase the risk of higher lifecycle repairs if inferior parts are used. Competent contractors quantify TCO over 5–10 years and model scenarios showing the break-even point where third-party savings offset potential increases in repair risk.

Insight 2: Warranty Status and Compliance Shape the First Decision

One decisive variable in the OEM vs third-party maintenance choice is warranty and compliance:

- While the manufacturer’s warranty is active, OEM servicing usually preserves warranty rights and avoids disputes over component failure causes.

- For projects requiring audited compliance (public works, regulated sites), OEM maintenance supplies traceable certificates and manufacturer-backed service records.

Once the warranty expires, many construction companies switch to third-party maintenance to capture cost savings while retaining OEM parts only where critically needed. The pragmatic shift between OEM and third-party maintenance maintains compliance throughout the warranty life and reduces long-term servicing budgets thereafter.

Insight 3: Fleet Diversity Favours Third-Party Providers

If your business runs a multi-brand fleet (e.g., Caterpillar, Volvo, JCB, Komatsu), third-party maintenance providers offer clear advantages:

- Consolidated servicing across brands.

- Single Service Level Agreement (SLA) for fleet uptime.

- Simplified spare-parts inventory management through compatible aftermarket options.

For large mixed fleets, an independent provider that understands the different systems of various manufacturers can reduce administrative overhead and speed up response times. Conversely, homogeneous fleets of a single make often gain from OEM economies of scale and deeper diagnostic integration.

Insight 4: Response Time and Local Presence Drive Uptime

One of the most tangible benefits of third-party maintenance is rapid on-site response. Local independent workshops and field engineers commonly deliver same-day visits and on-site repairs, which translates to fewer lost machine hours.

OEM maintenance models frequently rely on regional dealer networks and scheduled visits, which can be slower during peak seasons. For remote sites or projects where immediate recovery is critical, prioritise response-time metrics in SLAs. This is where third-party maintenance often surpasses OEM offerings in terms of pure uptime.

Insight 5: Diagnostic Access and Predictive Capability

Manufacturers provide proprietary diagnostic systems and telematics that unlock deep predictive maintenance capabilities. OEM maintenance often includes:

- Software updates and authenticated fault codes.

- Direct data pipelines to factory engineers.

- Early warnings for manufacturer-defined failure modes.

That said, third-party maintenance firms are rapidly closing the gap by using universal telematics, open-platform analytics, and AI-driven predictive tools. The optimal approach is a hybrid one: use OEM telematics for critical engines and hydraulics while allowing third-party technicians to act on data insights. This blend keeps the OEM vs third-party maintenance debate constructive rather than binary.

Insight 6: Parts Strategy; Genuine vs Aftermarket vs Remanufactured

Parts choice is central to maintenance cost efficiency:

- OEM (genuine) parts ensure exact fit and longevity, but at a higher cost.

- Aftermarket parts can offer comparable performance at a lower price if sourced from reputable manufacturers.

- Remanufactured components are often the best value for older machines.

A pragmatic parts policy OEM for high-stress components (turbochargers, main hydraulic pumps), a trusted aftermarket for filters and externals, and remanufactured for legacy units, allows contractors to balance reliability and savings. This tiered policy is a core element of cost-effective equipment servicing strategies.

Insight 7: Hybrid Models Deliver the Best Outcomes

The most substantial equipment fleets use hybrid maintenance models combining OEM precision with third-party flexibility. Typical hybrid frameworks include:

- OEM coverage for the warranty period and software maintenance.

- Third-party field service for routine inspections and quick fixes.

- Strategic use of OEM parts for critical systems and high-quality aftermarket elsewhere.

- Centralised fleet management platform aggregating OEM telematics and TPM reports.

This hybrid approach optimises maintenance cost efficiency while preserving technical assurance where it matters most, a practical resolution to the OEM vs third-party maintenance question.

Insight 8: Contracts, Service Level Agreements (SLAs) and Key Performance Indicators (KPIs); Make Them Watertight

Whichever path you choose, service contracts determine outcomes. A strong SLA for either OEM or third-party maintenance should include:

- Guaranteed mean time to repair (MTTR);

- parts availability targets (e.g., 95% within 24 hours);

- uptime percentage and liquidated damages for missed targets;

- transparency clauses for subcontracting and parts sourcing;

- Regular performance reviews with agreed KPIs.

Procurement teams often underappreciate the extent to which contracting details transform a maintenance provider into a strategic partner. Negotiate KPIs that reflect the actual project cost of downtime rather than vague service levels.

Insight 9: Risk Management: Safety, Liability, and Insurance

Maintenance strategy affects risk profiles:

- OEM servicing reduces technical blame disputes but can be costlier.

- Third-party maintenance requires clear liability and warranty transfer clauses; otherwise, insurers or clients may challenge coverage in the event of failures.

Ensure insurance policies and contract conditions explicitly accept the chosen maintenance model. For high-risk plants (tower cranes, mobile cranes), retaining an OEM or certified specialist for servicing may reduce insurer premiums and client objections.

Insight 10: Transition Planning and Capability Building

Switching from OEM to third-party maintenance—or vice versa—isn’t a flip of a switch. Transition planning matters:

- Map critical assets and their service histories.

- Build an internal knowledge base and overlap periods where OEM and TPM teams collaborate.

- Invest in technician training and accreditation programs to raise in-house capabilities.

- Pilot third-party support on non-critical assets before scaling up.

A phased, data-driven transition minimises mistakes and preserves fleet reliability while capturing cost gains. This approach is the operational embodiment of choosing between OEM vs third-party maintenance wisely.

Summary Table: Key Insights on OEM vs Third-Party Maintenance

| Insight | Core Information | Original Equipment Manufacturer (OEM) | Third-Party Advantage (TPM) |

| 1. Total Cost of Ownership (TCO) | Evaluate lifecycle cost, not just service price. | Higher resale value; predictable servicing. | Lower routine servicing cost; flexible pricing. |

| 2. Warranty & Compliance | Warranty period strongly favours OEM servicing. | Maintains warranty validity; complete compliance records. | Cost savings post-warranty; selective use of OEM parts. |

| 3. Fleet Diversity | Mixed-brand fleets benefit from consolidated servicing. | Best for single-brand fleets with integrated diagnostics. | One provider for all brands; simpler logistics. |

| 4. Response Time & Uptime | Local presence improves machine availability. | Strong expertise but slower regional scheduling. | Faster on-site response and same-day repairs. |

| 5. Diagnostics & Predictive Tools | Data access drives predictive maintenance accuracy. | Proprietary diagnostics; firmware-level insights. | Open-platform telematics; flexible analytics tools. |

| 6. Parts Strategy (OEM / Aftermarket / Reman) | Use a tiered parts strategy for cost efficiency. | Best for critical systems; guaranteed compatibility. | Lower-cost aftermarket options; reman for older machines. |

| 7. Hybrid Maintenance Models | Combining OEM + TPM optimises cost and reliability. | OEM handles complex systems & software. | TPM handles routine service & rapid repairs. |

| 8. Contracts, SLAs & KPIs | Strong contracts prevent downtime and cost overruns. | Established documentation and compliance paths. | More negotiable SLAs; tailored service packages. |

| 9. Risk, Liability & Insurance | Clear risk structure reduces disputes. | Stronger liability protection; insurer-friendly. | Requires strong contract terms; flexible coverage. |

| 10. Transition Planning | Gradual change avoids reliability dips. | OEM guidance during turnover phases. | Phased TPM rollout saves cost on mature fleets. |

The Advantages of OEM Maintenance

Despite the higher cost, OEM maintenance remains popular among firms prioritising reliability and long-term asset performance.

1. Guaranteed Parts and Compatibility

OEMs guarantee genuine spare parts with precise engineering tolerances. This ensures full mechanical and electronic compatibility, reducing the risk of premature failure.

2. Predictable Service Intervals

Manufacturers design maintenance schedules using performance data from global equipment fleets, offering evidence-based intervals optimised for uptime.

3. Warranty Preservation

Using OEM servicing protects warranties and retains resale value, an advantage particularly relevant for leased machinery.

4. Safety and Compliance

OEM service documentation ensures compliance with construction safety audits and ISO maintenance standards.

5. Advanced Diagnostics

Through proprietary diagnostic platforms, OEMs can detect and rectify faults before they escalate, a precursor to the adoption of predictive maintenance.

The Advantages of Third-Party Maintenance

Independent maintenance providers have gained traction among construction firms seeking agility and cost efficiency.

1. Significant Cost Savings

Third-party service contracts can cut maintenance expenses by up to 40%, freeing capital for project investment or fleet expansion.

2. Flexibility and Responsiveness

Third-party technicians often operate locally, offering same-day interventions for breakdowns.

3. Multi-Brand Expertise

TPM providers manage mixed fleets with ease, eliminating the need for multiple OEM contracts.

4. Customised Service Schedules

Unlike OEMs, independent firms tailor maintenance intervals to the site environment, such as adjusting for high dust levels or tropical climates.

5. End-of-Life Equipment Support

For older machinery, third-party suppliers can provide parts that are no longer stocked by OEMs, thereby extending the useful lifespan of assets.

Maintenance Cost Efficiency in Modern Construction

Construction firms today face increasing financial pressure from high equipment costs, tight project margins, and material inflation. Selecting the correct maintenance strategy has a direct impact on profitability and resource allocation.

- OEM maintenance ensures maximum performance and reliability, but comes at a higher lifecycle cost.

- Third-party maintenance maximises short-term savings and service flexibility but may require stricter internal quality control.

To optimise cost-efficiency, leading contractors employ a hybrid strategy, using OEM support for warranty equipment and TPM for mature fleets. This dual approach strikes a balance between reliability and affordability, resulting in long-term maintenance cost efficiency.

Interested in investing in construction equipment? Check out: Why You Should Invest in Construction Machinery and Equipment

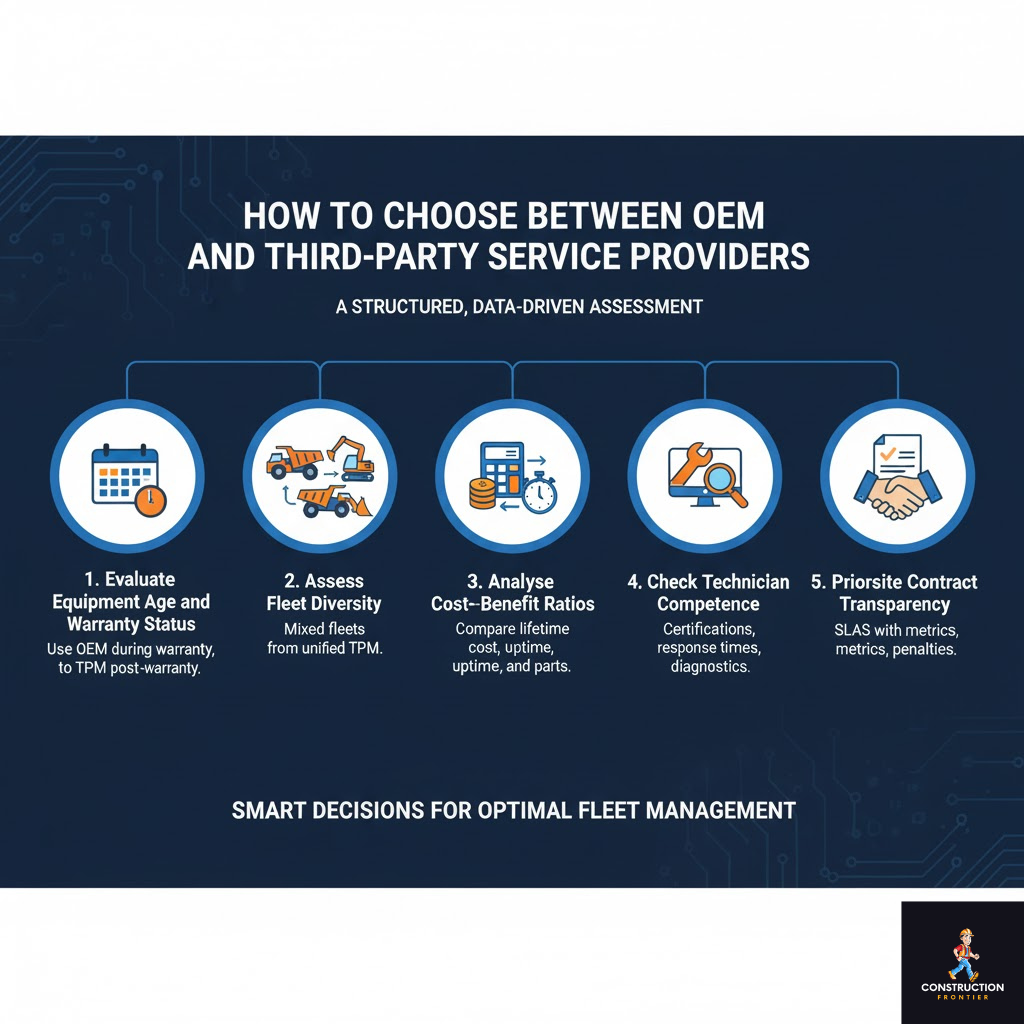

How to Choose Between OEM and Third-Party Service Providers

When evaluating how to choose between OEM and third-party service providers, construction managers should apply a structured, data-driven assessment:

1. Evaluate Equipment Age and Warranty Status

Use OEM maintenance during warranty, then transition to TPM when coverage ends.

2. Assess Fleet Diversity

A mixed-brand fleet benefits from TPM due to unified service management.

3. Analyse Cost–Benefit Ratios

Compare lifetime cost, not just per-service pricing. Consider downtime penalties, spare part quality, and labour reliability.

4. Check Technician Competence

Evaluate certifications, response times, and access to diagnostic technology.

5. Prioritise Contract Transparency

Ensure Service Level Agreements (SLAs) specify performance metrics, turnaround times, and penalties for non-compliance.

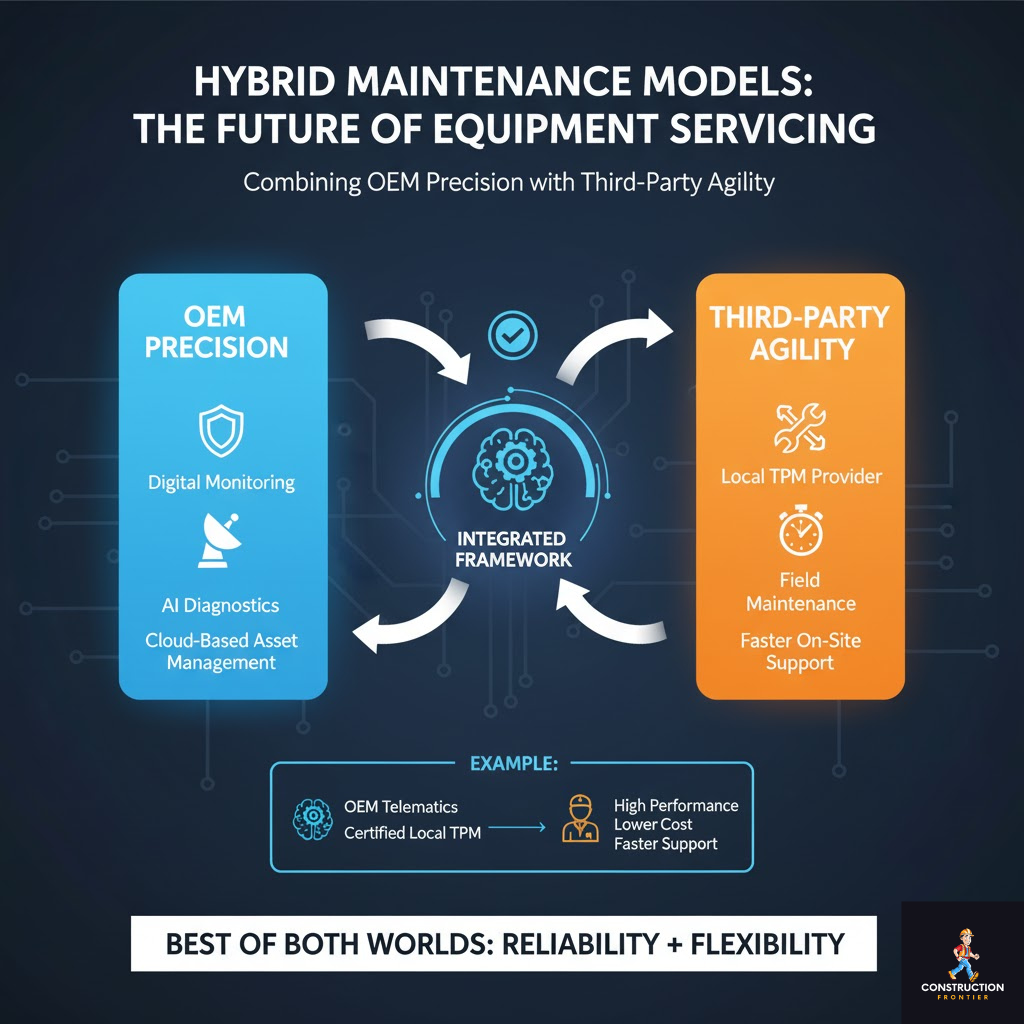

Hybrid Maintenance Models: The Future of Equipment Servicing

The future of construction equipment maintenance lies in hybrid frameworks combining OEM precision with third-party agility. Many leading firms now integrate digital monitoring, AI diagnostics, and cloud-based asset management software to harmonise both systems.

Example:

A major contractor might use OEM telematics for data collection while outsourcing field maintenance to a certified local TPM provider. This ensures high performance, lower cost, and faster on-site support.

This model aligns with global trends in predictive maintenance and AI-driven equipment servicing strategies, offering the best of both worlds: manufacturer-grade reliability with real-world operational flexibility.

Expert Insight: When Each Option Works Best

| Scenario | Recommended Strategy |

| Fleet under manufacturer warranty | OEM maintenance |

| Heavy-use fleet with expired warranty | Third-party maintenance |

| Remote site operations needing rapid support | Third-party maintenance |

| Government or compliance-bound contracts | OEM maintenance |

| Diverse equipment fleet (multi-brand) | Hybrid maintenance |

| Tight project budgets | Third-party or hybrid maintenance |

The Strategic Advantage of Predictive Maintenance Integration

The conversation around OEM vs third-party maintenance is evolving rapidly due to technological convergence. Predictive analytics, IoT sensors, and real-time performance data now allow both OEMs and TPMs to anticipate failures before they occur.

By integrating data-driven maintenance systems, contractors can schedule servicing precisely when required, minimising downtime and maximising machine lifespan. This approach reduces waste, enhances safety, and supports sustainability; the three core pillars of modern construction management.

Discover more about construction equipment maintenance: Proactive Equipment Care: Preventative Maintenance vs Reactive Maintenance in Construction Explained

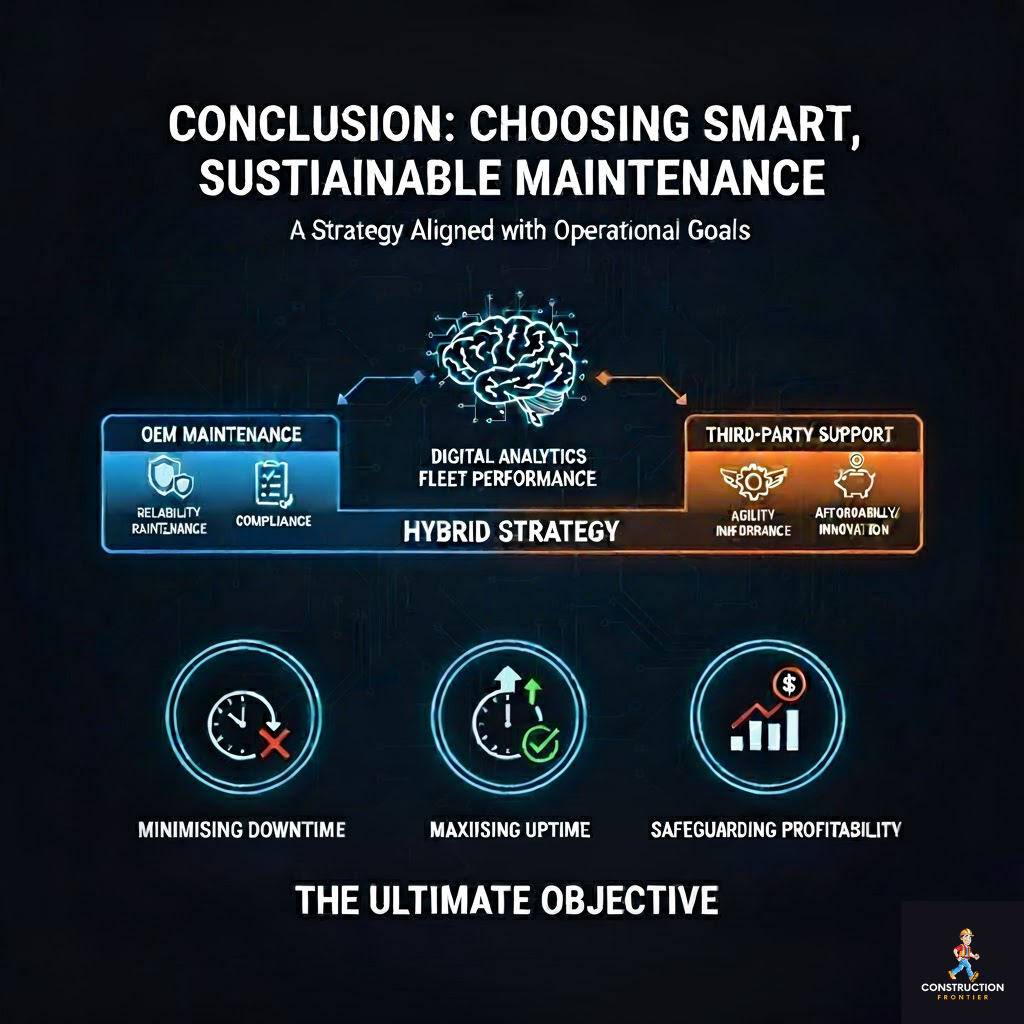

Conclusion: Choosing Smart, Sustainable Maintenance

The debate over OEM vs. third-party maintenance isn’t about choosing sides; it’s about selecting a strategy that aligns with your company’s operational goals. Both models have proven value. OEM maintenance delivers guaranteed reliability and compliance, while third-party support offers agility, affordability, and innovation.

Forward-thinking construction firms combine both approaches, using digital analytics to optimise fleet performance and service efficiency. Whether through OEM partnerships or independent service specialists, the ultimate objective remains the same: minimising downtime, maximising uptime, and safeguarding profitability.

Building Smart: Stay Ahead With ConstructionFrontier.com

At ConstructionFrontier.com, we explore the world’s most impactful innovations in engineering, maintenance, and project technology. Stay informed about cost-effective equipment maintenance strategies, sustainable design, and the latest insights shaping the future of construction efficiency.