The 11 Biggest Construction Fails of 2025: Costly Mistakes That Shook the Industry

The construction fails of 2025 exposed systemic weaknesses in megaproject governance, risk management, engineering coordination, and financial forecasting. From collapsed metro infrastructure in Bangkok to spiralling costs at Britain’s nuclear and rail megaprojects, 2025 marked a decisive year in which major construction mistakes triggered regulatory intervention, investor anxiety, and public scrutiny. These events offer critical lessons in construction risk management for contractors, engineers, governments, and institutional investors worldwide.

Introduction: Why 2025 Was a Turning Point for Construction Failures

The global construction market entered 2025 with momentum. Infrastructure stimulus packages continued across Europe, Asia, the Middle East, Australia, and North America. Governments accelerated energy transition projects. Developers pursued landmark real estate schemes. Rail, nuclear, and giga-infrastructure dominated capital pipelines.

Yet beneath the optimism, structural stress intensified.

Project complexity reached unprecedented levels. Nuclear builds integrated advanced reactor systems. Urban megaprojects layered transport, utilities, sustainability, and digital control networks into single delivery packages. Giga-developments in the Gulf attempted vertical cities and kilometre-long linear urban concepts. At the same time, inflationary volatility persisted, supply chains remained fragile, and labour markets tightened across advanced economies.

According to research published by McKinsey & Company, large capital projects typically run 30–45 percent over budget and behind schedule. The World Economic Forum has repeatedly warned that megaproject governance remains structurally weak in many jurisdictions. The Organisation for Economic Co-operation and Development (OECD) continues to highlight procurement inefficiencies and fragmented accountability as recurring risk factors in public infrastructure. Public procurement expenditure as a share of GDP increased significantly across the OECD over the last decade, from 11.8% in 2007 to 12.9% in 2021.

In 2025, those warnings materialised.

The biggest construction failures did not merely represent delayed buildings or inflated budgets. They disrupted energy security strategies. They reshaped national transport agendas. They triggered parliamentary inquiries, executive resignations, and contract renegotiations. They eroded investor confidence and strained contractor balance sheets.

This article does not assign blame. It delivers industry intelligence.

For construction professionals, understanding the biggest construction fails in 2025 provides clarity on what caused major construction project failures and, more importantly, how to prevent repeat mistakes. The lessons from failed construction projects in 2025 will influence procurement models, risk allocation frameworks, digital integration strategies, and capital planning decisions for the next decade.

What Defines a Major Construction Fail?

Not every delay qualifies as a headline failure. Construction remains inherently complex. Weather, logistics, permitting, and regulatory approvals frequently shift timelines. However, the construction fails of 2025 met a higher threshold.

We applied structured criteria grounded in engineering governance and financial impact.

Key Criteria Used in This Ranking

- Cost overruns beyond the original budget

Projects that experienced substantial deviations from approved capital expenditure forecasts. - Schedule delays and project suspensions

Schemes that faced multi-year delays, phased cancellations, or indefinite pauses. - Structural, safety, or design failures

Projects involving collapses, engineering faults, or compromised integrity. - Legal disputes, cancellations, or reputational impact

Projects that triggered litigation, diplomatic friction, or severe political consequences.

The projects below qualify as failed construction projects, not because they lacked ambition, but because their execution exposed structural weaknesses in construction risk management.

The 11 Biggest Construction Fails of 2025

The year 2025 exposed critical vulnerabilities across global infrastructure delivery systems. From transport megaproject overruns in Europe and North America to giga-development recalibrations in the Middle East and structural failures in Asia, the industry witnessed a series of high-profile setbacks that reshaped public confidence and investor sentiment.

This ranking of the 11 biggest construction failures of 2025 examines projects that experienced severe cost escalations, structural failures, funding instability, regulatory resistance, or prolonged suspensions. Each case offers strategic insight into what caused these major construction project failures and what the industry must change to prevent similar outcomes in future megaproject delivery.

Fail #1: Bangkok Metro Collapse | Thailand

Project Overview

Bangkok’s metro line system formed a critical part of Thailand’s urban mobility strategy. Ongoing extensions aimed to relieve congestion, integrate satellite districts, and support long-term economic growth. The project carried significant public investment and international contractor participation.

What Went Wrong

In 2025, a major structural collapse occurred during the construction of an elevated section above a road. Preliminary investigations pointed to formwork instability and inadequate supervision of temporary works. Local authorities examined potential lapses in design review and on-site quality assurance.

The incident underscored persistent global concerns raised by the International Labour Organisation regarding construction safety enforcement in fast-track urban projects.

Cost & Impact

Beyond immediate reconstruction costs, the collapse delayed network expansion, intensified regulatory inspections, and increased insurance premiums. Investor confidence in Thailand’s capacity to deliver urban transport weakened.

Key Lesson

Temporary works design deserves the same scrutiny as permanent structures. Construction project failures often originate in overlooked execution phases rather than conceptual engineering flaws.

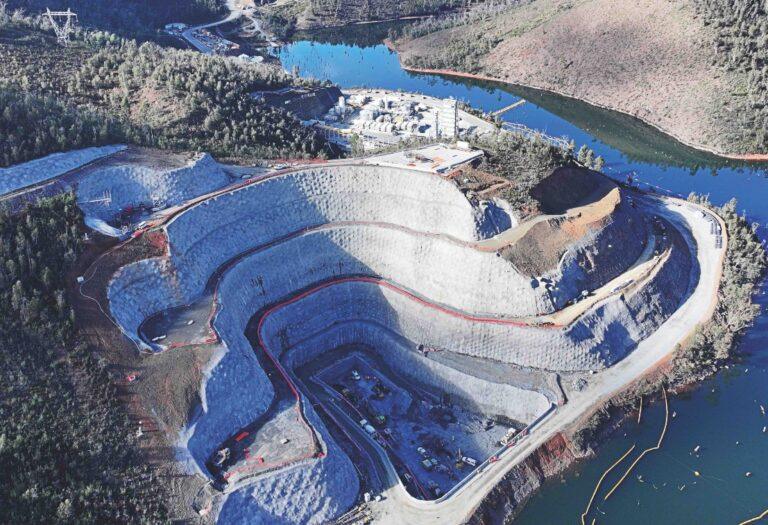

Fail #2: Snowy 2.0 | Australia

Project Background

Snowy 2.0, an expansion of Australia’s iconic pumped hydro scheme, aimed to provide 2,000 MW of dispatchable renewable energy capacity. The project formed a cornerstone of Australia’s energy transition strategy.

Root Causes of Failure

Geotechnical challenges during tunnelling operations led to repeated delays. Tunnel boring machines encountered unexpected ground conditions, slowing excavation and inflating costs. Contractual tensions between the client and delivery consortium compounded schedule pressure.

Public reporting in 2025 confirmed further cost escalations beyond earlier revised budgets.

Financial and Social Impact

Escalating capital expenditure increased uncertainty around electricity costs and political scrutiny. Stakeholders questioned governance structures and risk forecasting assumptions.

Lessons for Future Megaprojects

Complex underground works require conservative geotechnical modelling and contingency allowances. Many major construction mistakes stem from optimism bias in early feasibility studies. The experience reinforces broader lessons in construction risk management highlighted by the American Society of Civil Engineers in its megaproject oversight guidance.

Fail #3: Hinkley Point C | United Kingdom

Project Background

Hinkley Point C represents Britain’s first new nuclear power station in a generation. Led by EDF Energy, the project intends to deliver 3.2 GW of low-carbon electricity capacity.

Root Causes of Failure

By 2025, the project faced further cost inflation and timeline revisions beyond previous updates. Supply chain complexity, nuclear-grade component requirements, regulatory compliance, and post-pandemic inflation pressures compounded delivery risk.

The project exemplifies the structural governance fragility that the World Economic Forum identifies in megaprojects with multi-layered stakeholder frameworks.

Financial and Social Impact

Updated cost projections increased long-term consumer electricity price implications and intensified debate over nuclear financing models. Investor exposure expanded, while schedule certainty diminished.

Lessons for Future Megaprojects

Mega-energy infrastructure requires phased risk gates, independent technical audits, and transparent cost re-baselining. Construction industry lessons from Hinkley reinforce the importance of early contractor involvement and disciplined programme controls.

Fail #4: Manchester United’s New Stadium Redevelopment | United Kingdom

Project Overview

In 2025, redevelopment ambitions surrounding Manchester United’s stadium infrastructure re-entered the national debate. Proposals ranged from a major refurbishment of Old Trafford to the construction of an entirely new stadium complex integrated with transport and commercial real estate upgrades.

The project sat at the intersection of sport, urban regeneration, and private capital structuring.

What Went Wrong

Financing uncertainty dominated 2025. Ownership restructuring, capital-allocation debates, and questions about public-sector participation delayed firm commitments. Rising construction inflation across the UK complicated early-stage cost modelling.

Stakeholders also questioned the integration of infrastructure, including surrounding transport upgrades and utility reinforcement. Without confirmed financial closure, programme momentum stalled.

Cost & Impact

Uncertainty affected surrounding regeneration planning in Trafford. Contractors hesitated to allocate early-stage resources. Investors demanded clearer risk allocation frameworks before engagement.

Although no structural failure occurred, the project qualifies among the biggest construction fails in 2025 because strategic indecision created material delays and economic ripple effects.

Key Lesson

Megaprojects anchored in private capital require early financial clarity. Ambition without secured funding pipelines creates avoidable programme volatility. Construction project failures often begin in boardrooms, not on-site.

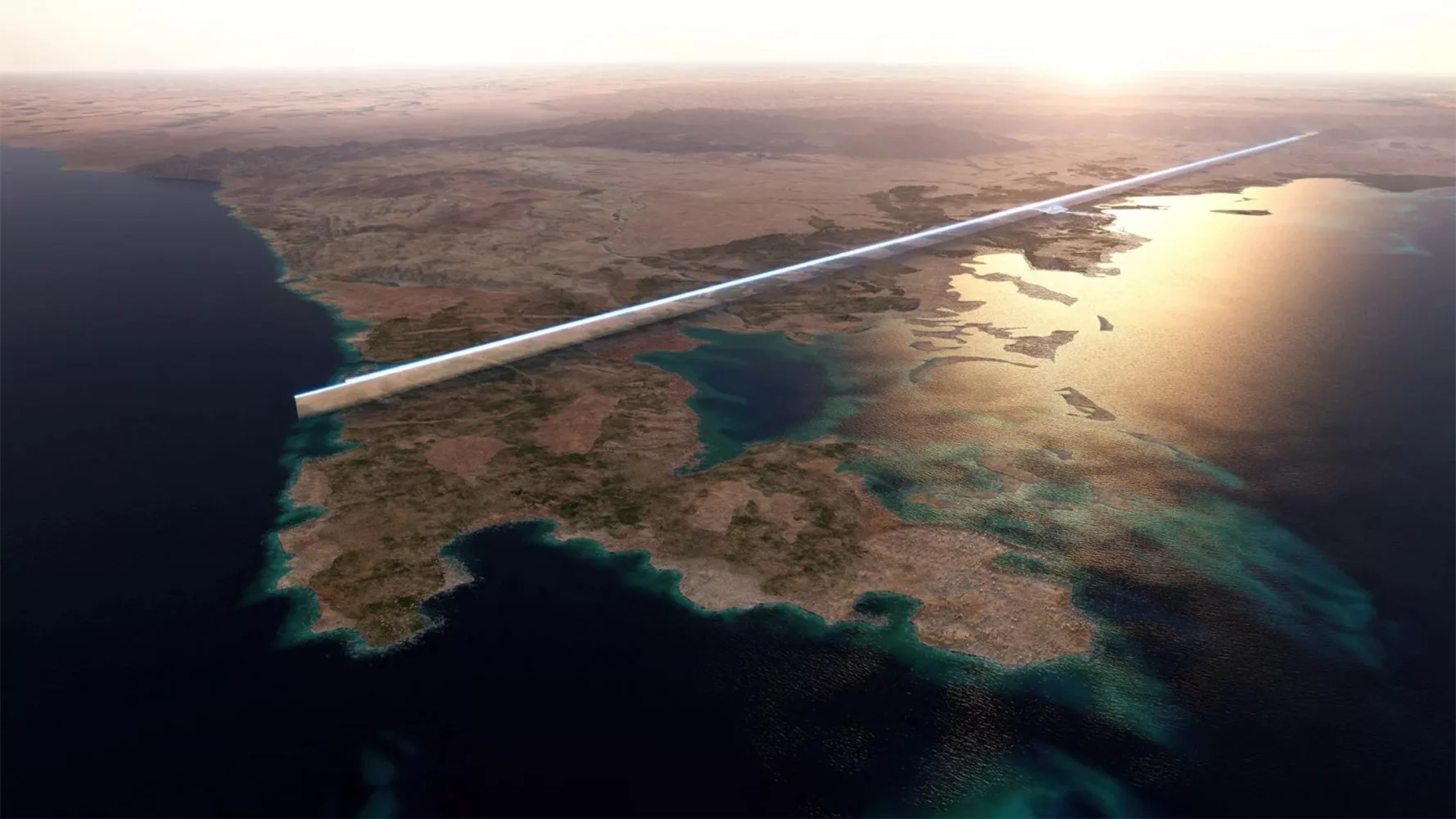

Fail #5: The Line | Saudi Arabia

Project Overview

The Line, part of Saudi Arabia’s NEOM development strategy, proposed a 170-kilometre linear smart city powered by renewable energy. The scale of the ambition redefined urban construction globally.

What Went Wrong

By 2025, reports indicated scaling adjustments and revised phasing strategies. Budget scrutiny intensified amid fluctuating oil revenues and global capital tightening. Technical execution challenges surrounding mirrored façade systems, high-density vertical infrastructure stacking, and logistics sequencing compounded pressure.

Large-scale labour mobilisation and supply chain coordination further complicated delivery. The World Economic Forum has long emphasised that megaproject governance must match design ambition. In this case, execution complexity collided with financial realism.

Cost & Impact

Revisions altered investor expectations and recalibrated global perceptions of giga-project feasibility. Contractors reassessed exposure levels. International suppliers renegotiated timelines.

Key Lesson

Visionary design must align with phased engineering reality. Among the lessons from failed construction projects in 2025, The Line reinforces the importance of scalable delivery frameworks over headline-driven announcements.

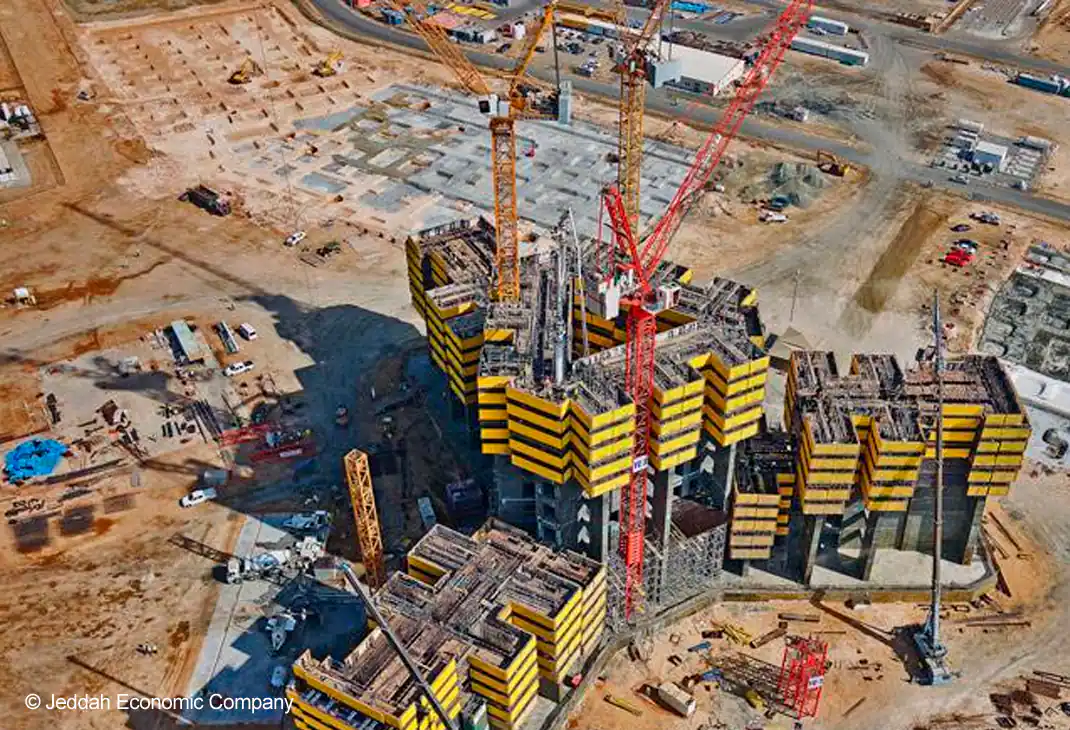

Fail #6: Jeddah Tower | Saudi Arabia

Project Overview

Jeddah Tower aimed to surpass one kilometre in height, positioning itself as the world’s tallest building. The tower symbolised national ambition and architectural prestige.

What Went Wrong

Construction faced prolonged suspension in previous years due to contractual disputes and broader political dynamics. In 2025, full-scale progress remained constrained by financing realignment and contractor restructuring challenges.

Ultra-high-rise engineering demands extreme coordination in vertical transportation systems, wind engineering, high-performance concrete pumping, and façade logistics. Restarting complex towers after prolonged pauses introduces additional risk layers.

Cost & Impact

Prolonged inactivity affected supplier chains and tied up capital. Market confidence in mega-tower financial models weakened. Developers globally reassessed their appetite for record-breaking vertical schemes.

Key Lesson

Super-tall construction amplifies compounding risk. The construction industry lessons from Jeddah Tower emphasise contractual resilience and financial continuity planning.

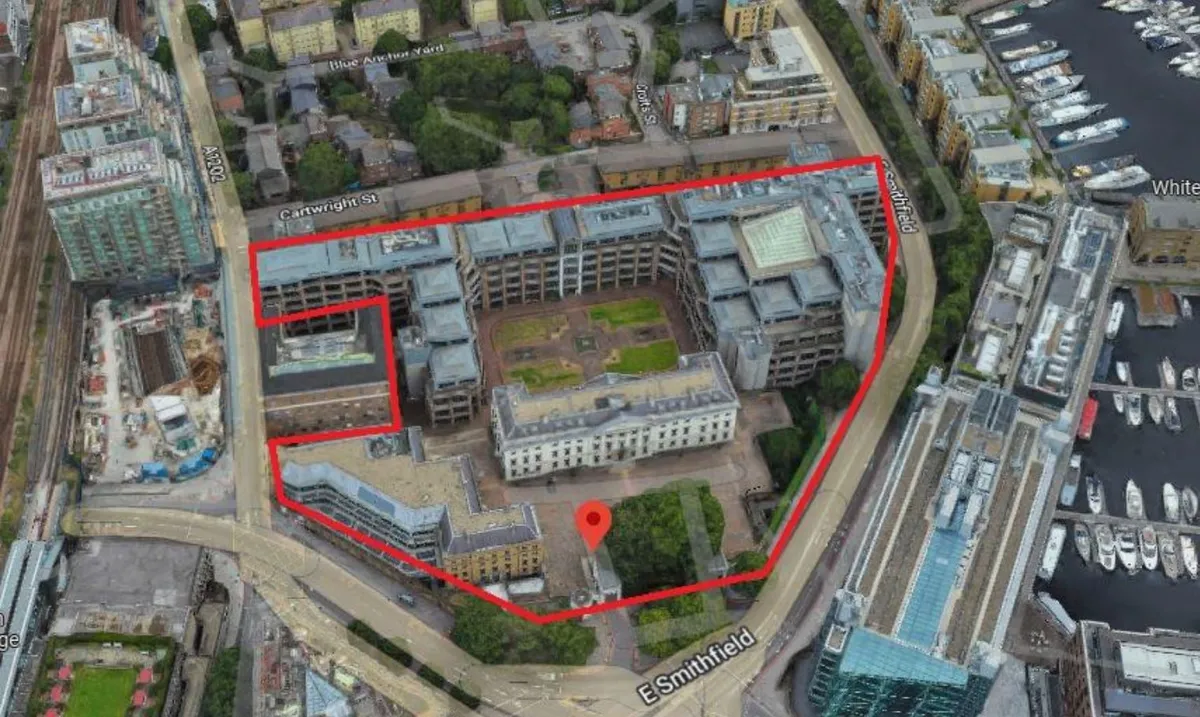

Fail #7: China’s Proposed New Embassy in London | United Kingdom

Project Overview

China’s large new embassy complex construction proposal in London’s Royal Mint Court. The development carried diplomatic, political, and urban planning implications.

What Went Wrong

Planning objections intensified over security concerns, traffic impact, and public safety risks. Local authorities and national stakeholders faced mounting pressure. In 2025, uncertainty around approval processes created a significant delay.

This case illustrates that construction risk management extends beyond engineering into geopolitics and community engagement.

Cost & Impact

Delays increased holding costs and strained diplomatic coordination. The case demonstrated how public infrastructure and diplomatic facilities face heightened scrutiny in volatile geopolitical climates.

Key Lesson

Stakeholder management must precede technical design. Construction project failures frequently stem from underestimating regulatory and political friction.

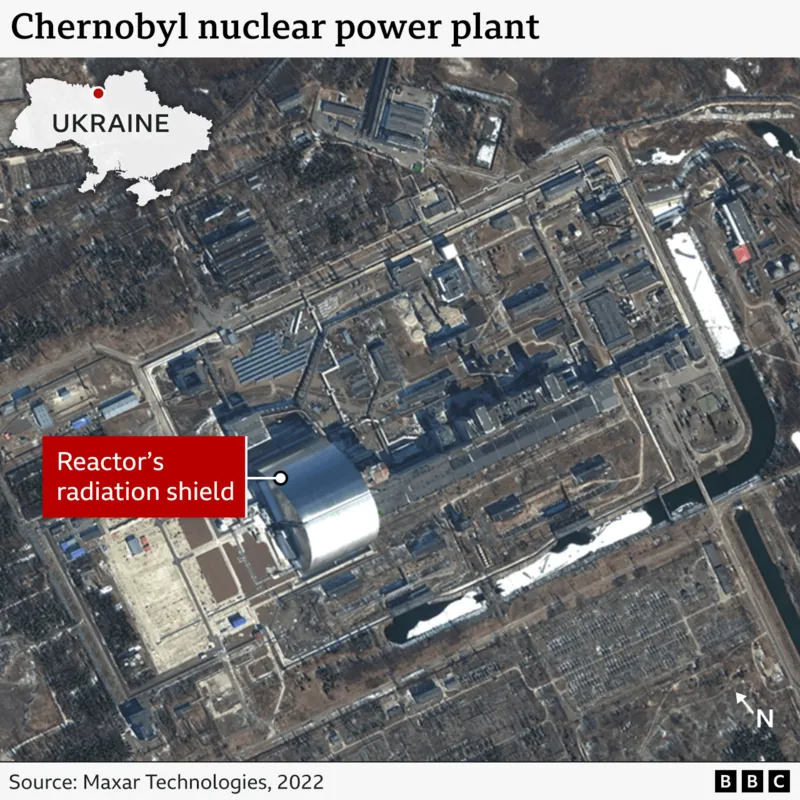

Fail #8: Chernobyl Site Drone Damage | Ukraine

Project Overview

The Chernobyl Exclusion Zone remains a sensitive nuclear containment site. The New Safe Confinement structure protects Reactor 4 from environmental exposure.

What Went Wrong

In 2025, reported drone-related damage within the region heightened concerns about infrastructure vulnerability in conflict zones. While not a conventional construction failure, the event exposed fragility in protective infrastructure resilience.

The International Atomic Energy Agency has consistently emphasised the importance of safeguarding nuclear infrastructure from physical threats.

Cost & Impact

Security upgrades, inspection regimes, and emergency contingency measures intensified. Reconstruction risk in active conflict zones remains one of the most complex dimensions of modern infrastructure.

Key Lesson

Construction governance must integrate geopolitical risk modelling. Engineering excellence alone cannot mitigate exposure to conflict.

Fail #9: Stuttgart 21 | Germany

Project Overview

Stuttgart 21 aims to transform Stuttgart’s rail infrastructure by converting a terminus station into an underground through-station and integrating high-speed European corridors. The project has faced controversy for more than a decade due to cost increases and public opposition.

What Went Wrong

In 2025, cost pressures and programme adjustments resurfaced as inflation, material cost volatility, and technical integration challenges compounded existing overruns. The complexity of underground excavation beneath an active urban core continued to stretch contingency allowances. German federal audit bodies intensified oversight amid budget expansion that strained public finances.

Cost & Impact

Escalating costs increased political scrutiny and reignited public protests. Contractors navigated heightened compliance checks. Programme certainty weakened.

Stuttgart 21 remains operationally viable, but it stands among the lessons from failed construction projects in 2025 because prolonged escalation eroded public trust and fiscal predictability.

Key Lesson

Urban rail megaprojects require transparent cost re-baselining and proactive public communication. Technical excellence alone cannot offset stakeholder fatigue when overruns accumulate.

Fail #10: California High-Speed Rail | United States

Project Overview

California High-Speed Rail aims to connect major cities with an electrified high-speed rail system. It represents one of the most ambitious transport programmes in the United States.

What Went Wrong

By 2025, continued funding gaps, land acquisition disputes, contractor coordination challenges, and cost escalation slowed momentum. Revised timelines extended delivery far beyond original projections.

Reports from the American Society of Civil Engineers have repeatedly warned that fragmented funding structures increase delivery risk in long-horizon infrastructure programmes.

Cost & Impact

Cost projections expanded significantly beyond early estimates. Political debates intensified regarding scope reduction and phased delivery strategies. Investor confidence fluctuated.

Key Lesson

Long-duration transport infrastructure requires stable, multi-decade funding guarantees. Stop-start appropriations destabilise contractor performance and inflate total lifecycle cost.

Fail #11: HS2 | United Kingdom

Project Overview

High Speed 2, widely known as HS2, was designed to enhance rail connectivity between London, Birmingham, and northern England. It represented one of Europe’s largest infrastructure programmes.

What Went Wrong

In 2025, after previous scope reductions, continued cost escalation, and political pressure, public perception of the programme’s viability was reshaped. Budget increases, environmental mitigation expenses, and land compensation costs expanded total expenditure.

The National Audit Office has repeatedly highlighted weaknesses in early cost forecasting and schedule realism across major UK infrastructure projects.

Cost & Impact

Scope reductions altered regional development expectations. Contractors restructured delivery packages. Debates over long-term infrastructure strategy intensified across Westminster.

HS2 illustrates a central theme of the construction fails of 2025. Early optimism bias can distort long-term fiscal exposure.

Key Lesson

Governments must align political timelines with engineering timelines. Infrastructure cannot compress reality to satisfy electoral cycles.

Cross-Project Analysis: Why Major Construction Projects Fail

McKinsey & Company has repeatedly shown through global capital project research that large construction schemes systematically exceed budgets and schedules. Their longitudinal studies of megaprojects across transport, energy, and urban development sectors identify structural governance and forecasting weaknesses rather than isolated technical errors. The construction failures seen in 2025 reflect the same systemic patterns.

1. Optimism Bias Distorts Feasibility

Optimism bias manifests during concept approval and early business case development. Sponsors frequently underestimate ground risk, utility relocation complexity, land acquisition timelines, and supply chain volatility.

In rail and tunnelling schemes, preliminary cost models often rely on high-level geotechnical assumptions rather than detailed subsurface investigation. Once excavation begins, unexpected soil conditions, groundwater behaviour, or fault zones force redesign and drive variation claims.

Academic research from Oxford’s Saïd Business School shows that transport megaprojects average cost overruns of 30 to 50 percent globally, with rail projects performing worse than roads. The root driver is not poor construction productivity. It is systematically understated baseline estimation during approval phases.

Political cycles intensify this bias. Governments prioritise headline affordability to secure parliamentary or public support. When detailed engineering replaces conceptual estimates, the gap between promise and reality becomes visible. By then, sunk-cost pressure discourages cancellation.

2. Fragmented Risk Allocation

Public-private partnerships frequently fail to distribute risk to the party best able to manage it. Instead, contracts often transfer geotechnical, interface, or demand risk to private consortia without corresponding control authority.

When ground conditions diverge from reference models, contractors pursue compensation events. Dispute resolution mechanisms then slow progress, inflate legal costs, and erode collaboration.

In large energy and rail projects worldwide, misaligned incentives among concessionaires, EPC contractors, and public authorities have extended timelines by years. Contractual rigidity reduces adaptive response capacity when material price shocks, labour shortages, or regulatory shifts occur.

Effective risk allocation requires:

- Clear geotechnical baseline reports.

- Transparent variation thresholds.

- Shared contingency buffers.

- Dispute boards active from early phases.

Where these mechanisms remain weak, friction compounds technical challenges.

3. Governance Misalignment

Megaproject governance must outlast electoral cycles, ministerial reshuffles, and leadership transitions. Projects extending beyond ten years require institutional continuity, not political volatility.

The Organisation for Economic Co-operation and Development emphasises three pillars for infrastructure governance: transparency, accountability, and lifecycle oversight. Independent review bodies, structured gateway approvals, and open procurement reporting reduce strategic drift.

Where governance structures change midstream, scope revisions, funding uncertainty, and policy reversals destabilise execution. Strategic re-scoping often forces redesign, procurement resets, and contractor renegotiation. These disruptions increase interface risk and dilute original value propositions.

Long-duration projects must therefore embed governance architecture in statute or binding intergovernmental agreements rather than informal political consensus.

4. Restart and Suspension Risk

Construction suspension creates compound technical and commercial exposure.

When works pause for extended periods:

- Partially completed structures deteriorate.

- Specialist subcontractors demobilise.

- Equipment leases terminate.

- Skilled labour disperses.

- Insurance conditions change.

Restarting requires remobilisation, updated compliance checks, revised safety audits, and revalidation of design assumptions against new codes or standards. Inflation during suspension increases procurement cost. Currency fluctuations alter imported material pricing.

Interface risks escalate because original sequencing assumptions no longer hold. New contractors may inherit incomplete documentation or incompatible work packages.

Data from global project insurers shows that restart scenarios typically increase total cost exposure by 15 to 25 percent beyond initial suspension losses.

5. Geopolitical and Security Exposure

Large infrastructure now operates within broader geopolitical risk ecosystems. Critical assets such as nuclear facilities, data centres, ports, and energy corridors face physical and cyber threats.

The International Atomic Energy Agency has repeatedly stressed that nuclear facility protection requires continuous reassessment of evolving threat profiles. Drone incursions and cyber vulnerabilities illustrate how traditional perimeter security assumptions no longer suffice.

For contractors and asset owners, geopolitical risk translates into:

- Insurance premium escalation.

- Increased security infrastructure requirements.

- Regulatory scrutiny.

- Supply chain disruptions tied to sanctions or conflict.

Infrastructure risk management now extends beyond engineering reliability into national security strategy.

Strategic Construction Risk Management Lessons for 2026 and Beyond

The construction sector must treat the construction fails of 2025 as structural warnings rather than anomalies. Below are some of the mitigation strategies.

1. Strengthen Early-Stage Front-End Engineering Design

Front-End Engineering Design determines cost accuracy and constructability resilience. Developers must:

- Conduct advanced geotechnical site investigations.

- Apply probabilistic cost modelling.

- Integrate constructability reviews during conceptual design.

- Model logistics constraints and supply chain exposure.

International benchmarking shows that projects investing at least 3 to 5 percent of total capital expenditure in pre-construction planning achieve significantly lower variance at delivery.

2. Build Contingency Discipline

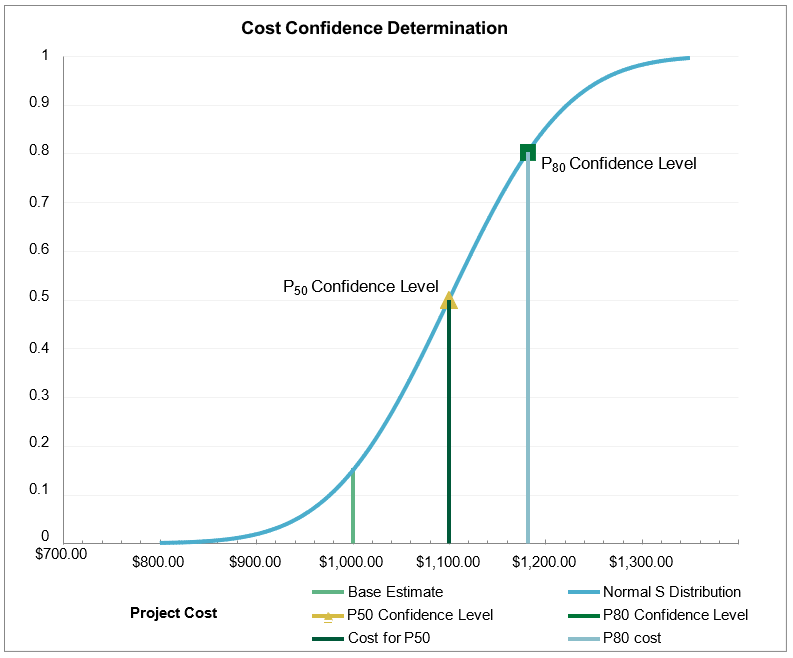

Contingency must reflect quantified risk registers rather than political optics. Monte Carlo simulations and scenario-based modelling provide probability distributions for cost and schedule outcomes.

Transparent reporting of P50 and P80 cost estimates improves investor confidence and reduces the risk of later credibility crises. Contingency drawdown governance must require executive-level justification and independent validation.

3. Align Funding with Lifecycle Reality

Infrastructure assets operate for over 30 to 100 years. Short-term annual budget cycles destabilise delivery. Stable multiyear capital frameworks, infrastructure funds, and ring-fenced financing mechanisms reduce stop-start execution risk.

Blended finance structures can mitigate exposure where sovereign fiscal space remains constrained. Lifecycle costing must incorporate maintenance, asset renewal, and decommissioning obligations, not merely construction outlay.

4. Increase Independent Oversight

Independent technical and financial auditors should review:

- Baseline cost assumptions.

- Risk allocation matrices.

- Procurement structures.

- Delivery model suitability.

Gateway review processes, when embedded early, prevent escalation of unrealistic proposals into politically irreversible commitments.

5. Digitise Risk Monitoring

Integrated digital platforms enhance visibility across project interfaces. Building Information Modelling systems combined with real-time progress dashboards enable deviation detection before schedule slippage becomes critical. Predictive analytics applied to procurement data can flag supplier distress or material shortages early. Digital twins and sensor-based monitoring improve tracking of structural performance and reduce uncertainty in long-duration infrastructure assets.

The lesson from the construction fails of 2025 is clear. Megaproject failure rarely results from a single technical flaw. It emerges from systemic misalignment between estimation realism, governance discipline, contractual structure, and evolving risk environments. Projects that internalise these lessons in 2026 will reduce volatility, preserve capital, and rebuild public trust in large-scale infrastructure delivery.

Further Reading: Revolutionary Smart Sensors in Concrete: 10 Key Metrics They Monitor to Improve Structural Performance

Conclusion: Failure as Industry Intelligence

The construction fails of 2025 did not merely represent setbacks. They exposed systemic weaknesses across global infrastructure ecosystems. Urban rail collapses, nuclear overruns, giga-city recalibrations, embassy delays, supertower stagnation, and high-speed rail turbulence all reveal the same truth. Modern construction operates inside complex political, financial, environmental, and geopolitical systems.

Contractors must integrate financial modelling discipline. Governments must align their ambitions with their governance capacity. Investors must demand transparent risk reporting. Engineers must elevate oversight in the execution phase with the same intensity applied to design. The biggest construction fails in 2025 will shape procurement reform, cost modelling methodology, and megaproject governance frameworks for years to come.

For construction leaders, these failures provide clarity. They highlight where systems cracked. They illuminate where discipline must strengthen. And they reinforce a fundamental industry principle: Ambition builds skylines. Discipline delivers them.

Stay Ahead with Construction Frontier

The construction fails of 2025 show that informed leaders outperform reactive ones. Stay ahead of global megaproject risks, procurement reform, and infrastructure intelligence by visiting ConstructionFrontier.com, your trusted source for strategic construction analysis and industry insight.