Hydrogen Infrastructure: Powering the Global Green Energy Transition

Hydrogen infrastructure is fast emerging as the backbone of the clean energy future. From storage and pipelines to global megaprojects, it enables renewable power to move across industries, seasons, and borders, unlocking the green energy transition.

Why Hydrogen Infrastructure Matters

Enter hydrogen infrastructure, the hidden enabler of the global green energy transition. The race toward a low-carbon world is no longer theoretical; it is happening in real time. Solar and wind dominate new electricity additions, but renewables alone cannot solve decarbonisation’s storage, distribution, and heavy-industry challenges.

Far from being just an industrial curiosity, hydrogen has the potential to become the connective tissue of tomorrow’s energy systems. Through pipelines, storage facilities, refuelling stations, and international trade routes, hydrogen infrastructure is bridging gaps that batteries and grids cannot fill. This article explores how it works, where the major projects are happening, and why it could become the backbone of the hydrogen economy development.

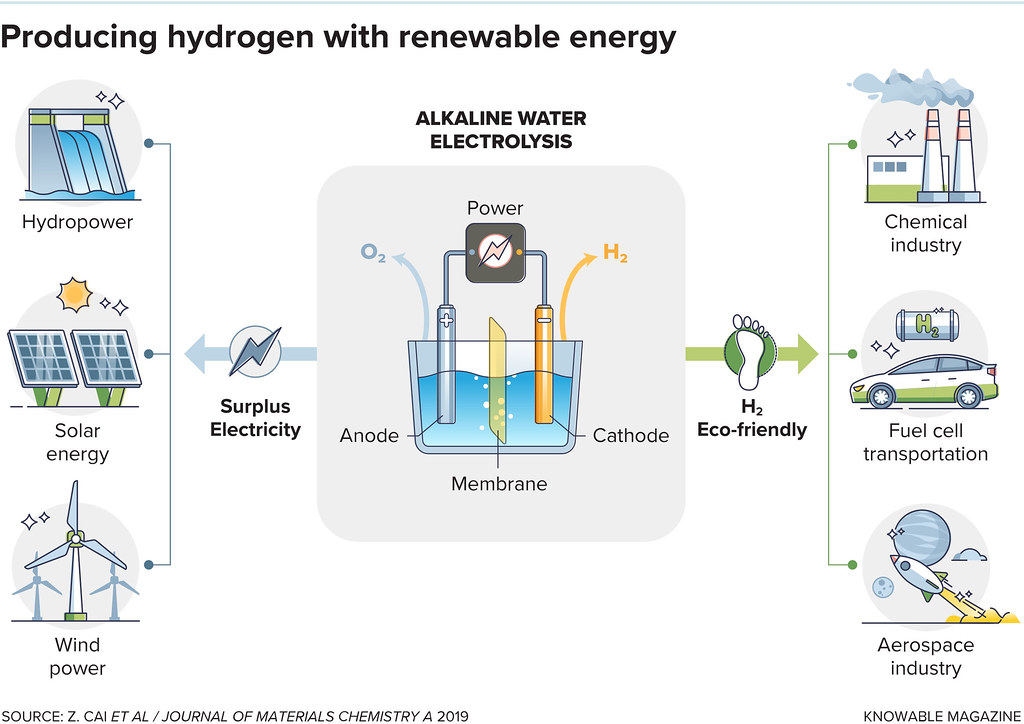

The Role of Hydrogen Infrastructure in the Green Energy Transition

Hydrogen infrastructure is more than tanks and pipes; it’s the operating system of a multi-vector energy future. Converting renewable electricity into hydrogen, storing it, and distributing it to industries and transport sectors enables deep decarbonisation.

- Energy storage & flexibility: Unlike batteries, hydrogen can store energy for weeks or months, smoothing seasonal gaps in renewable generation. For instance, when wind output in Europe dips during the summer, hydrogen produced during spring peaks can keep industries running.

- Sector integration: Pipelines and refuelling networks allow hydrogen to flow seamlessly from production plants to transport, heavy industry, and even electricity grids during peak demand.

- Hard-to-abate sectors: Hydrogen is critical for the cement, steel, and shipping industries. Electrification alone cannot provide the high heat or fuel density required, but hydrogen can.

Without a strong hydrogen infrastructure, the hydrogen economy remains trapped in research labs and pilot projects. With it, hydrogen becomes a scalable, flexible tool for global decarbonisation.

Global Hydrogen Energy Projects Reshaping Clean Energy

Hydrogen energy projects worldwide are transitioning from pilot scale to commercial and industrial megaprojects.

- Europe’s Hydrogen Backbone (EHB): A proposed 20,000–30,000 km network of dedicated and repurposed pipelines by 2040, designed to carry green and blue hydrogen across the continent. This could connect renewable-rich areas like the North Sea to industrial clusters in Germany, the Netherlands, and France.

- Japan’s import strategy: Japan, with limited renewable land capacity, is investing heavily in hydrogen imports. Projects include partnerships with Australia and the Middle East to secure supply and the development of liquid hydrogen carriers.

- Saudi Arabia’s NEOM project: One of the world’s largest planned green hydrogen projects, currently at 80% completion. Powered by 4 GW solar and wind generation sites, it aims to export ammonia-based hydrogen to Europe and Asia by 2026.

- Australia’s hydrogen hubs: Coastal hubs like Gladstone and Pilbara are positioned to serve as major Asian exporters. These hubs integrate production, storage, and shipping terminals.

- United States initiatives: The U.S. Department of Energy has allocated billions through its Hydrogen Shot program, aiming to reduce green hydrogen costs to $1/kg within a decade. Multiple “hydrogen hubs” are also being developed across the country.

Each of these projects demonstrates how hydrogen fuel infrastructure is no longer theoretical but a tangible ecosystem of pipelines, ports, and storage supporting the clean energy transition.

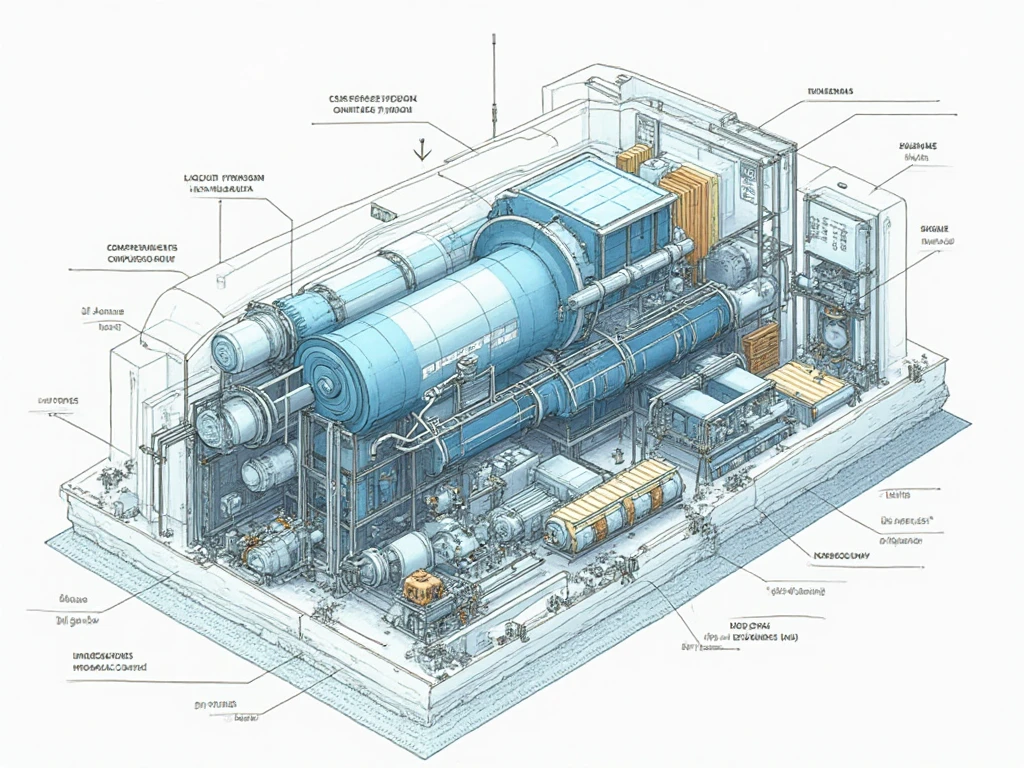

Hydrogen Storage and Distribution: The Core Challenge

Hydrogen is the most abundant element in the universe, but handling it at scale is not straightforward. Its low density, small molecular size, and reactivity make storage and transport complex.

Storage Methods

- Compressed gas (200–700 bar): Common for refuelling vehicles, but requires strong tanks and high compression costs.

- Liquid hydrogen (LH2): Provides higher density but requires extreme cooling at –253°C, consuming high energy.

- Chemical carriers: Hydrogen can be bound into ammonia, methanol, or liquid organic hydrogen carriers (LOHC). While easier to ship, these require reconversion.

- Geological storage: Salt caverns and depleted gas fields are promising for large-scale, seasonal storage, though limited geographically.

Distribution Challenges

- Pipeline embrittlement: Hydrogen molecules can weaken steel pipelines, requiring advanced materials or protective linings.

- Compression energy losses: Transporting hydrogen via pipelines or tankers consumes part of its energy value.

- Safety concerns: While hydrogen disperses quickly, its flammability demands careful infrastructure design and monitoring.

Advances in hydrogen pipelines, storage, and distribution systems are tackling these issues, with digital monitoring, new alloys, and safer tank designs leading the way.

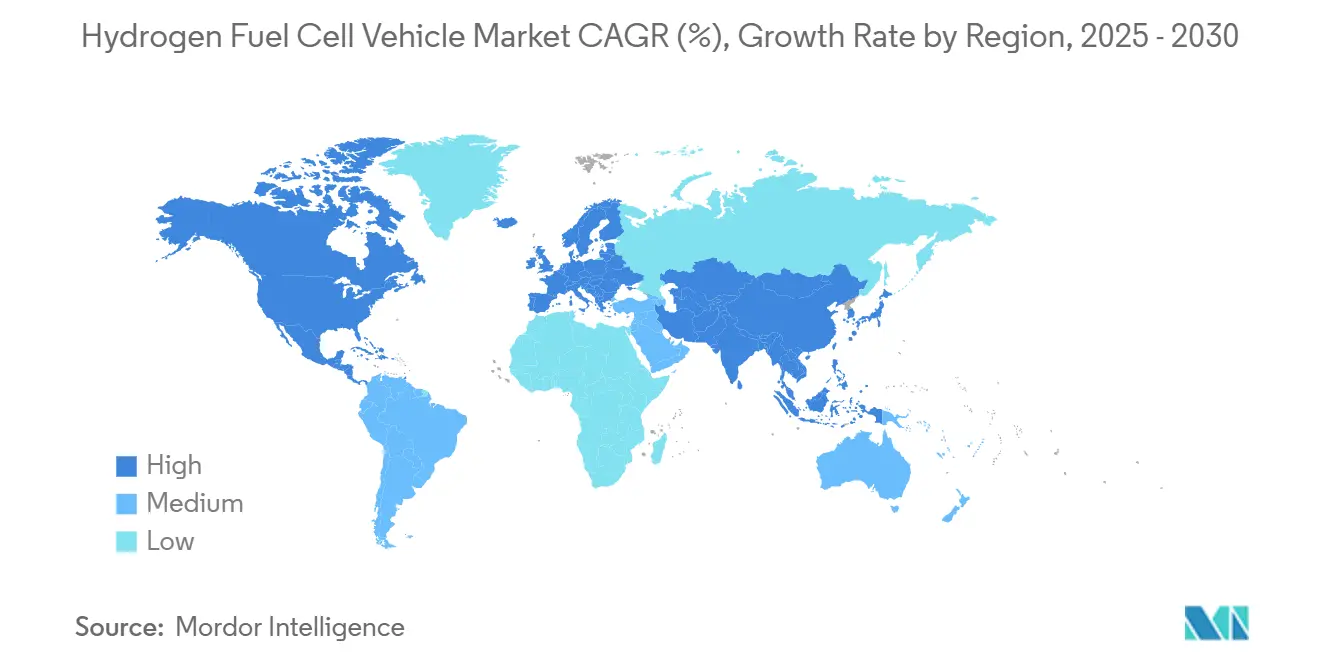

Hydrogen Fuel Infrastructure and the Transportation Revolution

Transport accounts for nearly a quarter of global CO₂ emissions, and hydrogen is emerging as a viable alternative for segments where batteries fall short.

- Refuelling stations: Japan leads globally, with more than 150 hydrogen refuelling stations, followed closely by Germany and South Korea. The U.S. has concentrated networks in California.

- Heavy-duty vehicles: Hydrogen fuel cells are superior to batteries for long-haul trucks, buses, and non-electrified rail lines due to quicker refuelling and longer ranges. JCB recently unveiled its hydrogen-powered excavators, which the UK has approved for road use.

- Shipping & aviation: Pilots are underway for ammonia-fuelled vessels and synthetic fuels derived from hydrogen for planes. Airbus is targeting hydrogen-powered commercial aircraft by 2035

Hydrogen fuel infrastructure could rewrite the playbook for long-distance, high-demand transport sectors.

Investment Opportunities in Hydrogen Infrastructure Projects

Hydrogen is not just an environmental imperative; it’s also a financial opportunity.

- Where investment is needed most: electrolysers, hydrogen hubs, pipelines, underground storage, and refuelling stations.

- Attractive models: Public-private partnerships (PPP) are common, while some projects use “tolling” models, in which investors earn fees for moving hydrogen.

- Risks and barriers: Costs remain high, and policies vary by region. However, carbon pricing, renewable energy incentives, and international trade agreements are de-risking investments.

The International Energy Agency (IEA) estimates that by 2050, hydrogen could meet 10–12% of global energy demand, creating a trillion-dollar market for investors.

Hydrogen Pipelines, Storage, and Distribution Systems in the Energy Transition

As countries build out hydrogen infrastructure, three key models are emerging:

- Pipeline networks: Retrofitting natural gas pipelines for blends of up to 20% hydrogen is already underway, but dedicated hydrogen lines are considered the long-term solution.

- Seasonal storage: Large underground facilities, like salt caverns, can store hydrogen cheaply, stabilising supply when renewable generation fluctuates or during peak demand periods.

- Hub-and-spoke systems: Industrial hydrogen hubs connected to spokes (transport refuelling stations or smaller industrial users) minimise distribution costs.

The challenge is ensuring interoperability across borders. Hydrogen flowing from an electrolyser in Morocco to a steel plant in Germany requires aligned safety standards, pressure ratings, and certification systems.

The Future of Hydrogen Energy and Sustainable Infrastructure

The future of hydrogen rests on three interconnected pillars:

- Technology breakthroughs: Cheaper electrolysers, efficient fuel cells, and advanced storage tanks will dramatically reduce hydrogen fuel costs.

- Policy frameworks: Carbon pricing, hydrogen guarantees of origin, and subsidies are already driving adoption in Europe, the U.S., and Asia.

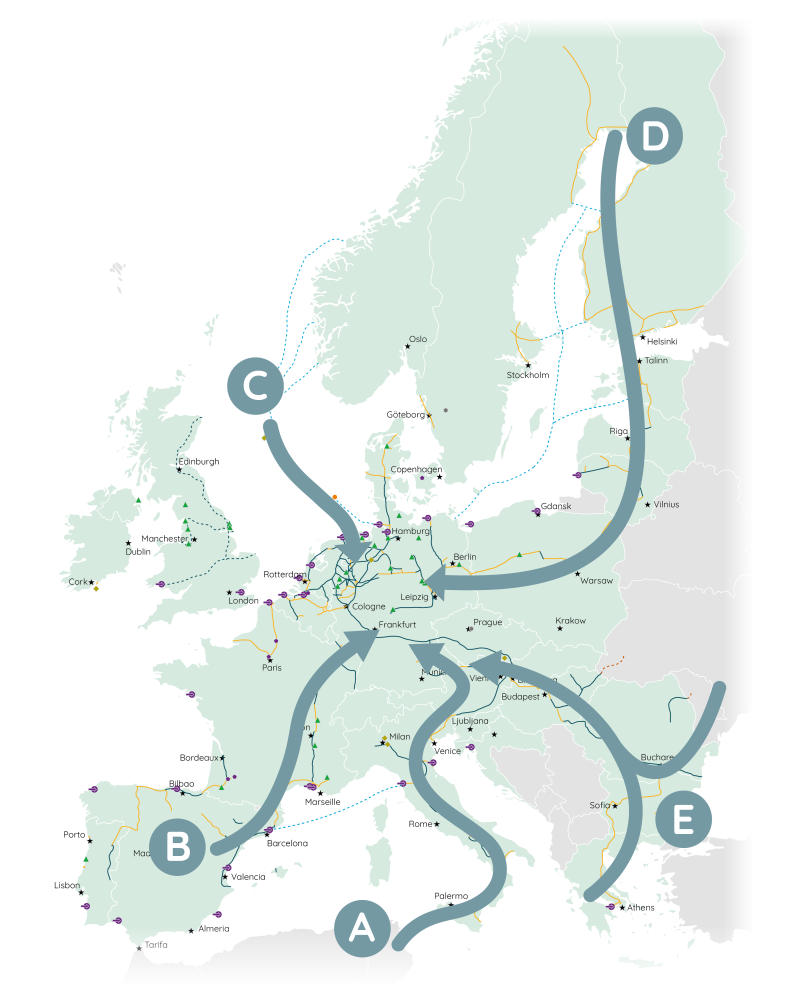

- Global collaboration: International “hydrogen corridors” are being planned, linking supply-rich countries like Australia and Chile with demand-heavy regions like Japan and Europe.

In Europe, there will be five planned hydrogen supply corridors by 2030, which are:

Corridor A: North Africa & Southern Europe

Corridor B: Southwest Europe & North Africa

Corridor C: North Sea

Corridor D: Nordic and Baltic regions

Corridor E: East and South-East Europe

If these trends converge, hydrogen could become a globally traded commodity, much like oil today, but with none of the carbon footprint.

Building the Hydrogen Economy: Challenges and Opportunities

Hydrogen faces a classic chicken-and-egg problem: industries won’t adopt it without infrastructure, but infrastructure is expensive to build without guaranteed demand.

Key Challenges

- Cost gap: Green hydrogen is still typically more expensive than fossil hydrogen and competing low-carbon alternatives in many uses. Closing the gap requires cheaper renewables, electrolysers, and scale.

- Infrastructure “chicken-and-egg” dilemma: Producers need offtakers; offtakers need a reliable, affordable supply. Coordinated public action and anchor projects (industrial decarbonisation commitments) help break the impasse.

- Standards and safety: New codes, workforce training, and public communication are needed to build trust. Hydrogen’s public profile is still nascent and occasionally misunderstood.

- Supply chain and materials: Electrolysers rely on specific materials and manufacturing capacity — scaling requires investment across the upstream supply chain.

Opportunities to Seize

- Industrial renewal and jobs: Building electrolysers, pipelines, and refuelling networks creates local manufacturing and high-skill jobs. Countries that invest early can capture value chains.

- Export revenue and energy security: Renewable-rich nations can monetise clean energy by producing hydrogen for export, diversifying their economies.

- Climate and health co-benefits: Replacing fossil fuels in industry and transport reduces local air pollution and greenhouse gas emissions.

- Practical policy levers: Governments can accelerate deployment by committing to hydrogen in public procurement, offering revenue-stabilising mechanisms (contracts for differences), and investing in backbone infrastructure that reduces private capital’s first-mover risk.

Countries like Germany and South Korea are tackling this by funding early infrastructure build-out, ensuring that demand can follow. If replicated globally, the hydrogen economy could move from niche to mainstream within a decade.

Conclusion: Why Hydrogen Infrastructure Matters Now

Hydrogen infrastructure is an energy option and the foundation of the green energy transition. From hydrogen storage and distribution to international hydrogen pipelines and mega hydrogen energy projects, the path forward is clear: investing in robust hydrogen systems today will determine the speed and success of the global shift to clean energy.

The world’s energy future will be shaped by how well we scale hydrogen fuel infrastructure, integrate it into national grids, and make it accessible to industries and communities worldwide.

Stay Informed with Construction Frontier

Explore more on the clean energy transition. For in-depth insights on construction, infrastructure, and energy in Africa and emerging markets, visit ConstructionFrontier.com.