John Deere Tenna Acquisition Strengthens Smart Fleet Tools

The John Deere Tenna acquisition marks a strategic expansion of John Deere’s smart fleet tools, strengthening its digital construction ecosystem and advancing telematics-driven fleet management across global construction markets.

John Deere Tenna Acquisition Signals a Strategic Shift in Digital Construction

The John Deere Tenna acquisition represents more than a routine technology purchase. It signals a deliberate shift in how one of the world’s most established equipment manufacturers approaches digital construction, fleet intelligence, and data-driven decision-making.

As equipment fleets grow larger and more complex, contractors increasingly demand unified visibility across mixed-brand assets. By acquiring Tenna, John Deere moves decisively to close a long-standing gap in the construction equipment telematics space.

For Construction Frontier, this deal reflects a broader industry transition where data platforms now matter as much as machines.

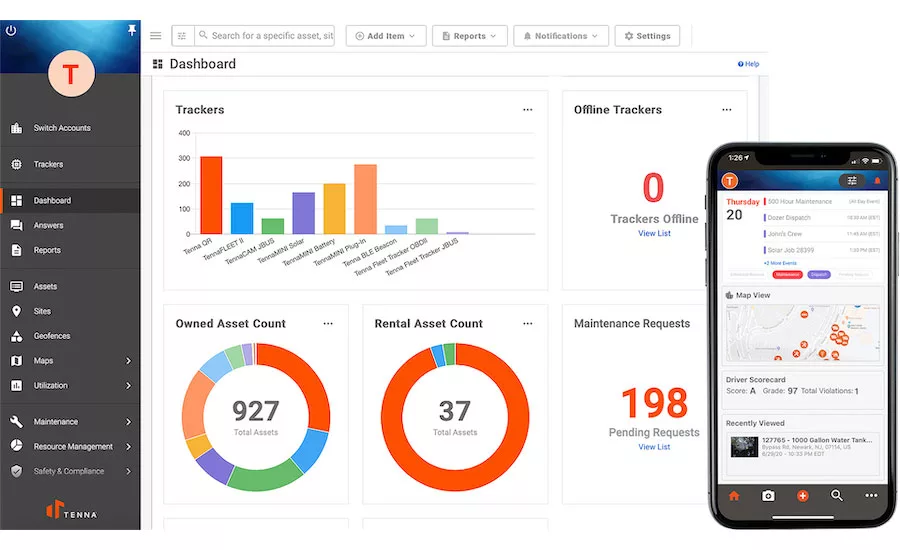

Understanding the Tenna Fleet Management Platform

The Tenna fleet management platform is widely recognised for its ability to aggregate data across diverse equipment types, manufacturers, and asset classes.

Key capabilities include:

- Real-time tracking of equipment location and utilisation.

- Integration of telematics data from multiple OEMs.

- Maintenance scheduling and compliance monitoring.

- Asset visibility for owned, rented, and leased equipment.

These features explain why John Deere acquires Tenna fleet platform rather than building a competing system from scratch. Tenna’s platform-neutral architecture complements John Deere’s existing digital tools while extending reach beyond Deere-branded equipment.

Why John Deere Acquired Tenna Now

The timing of the John Deere Tenna acquisition reflects mounting pressures across the construction sector.

Several forces converged:

- Fleet Fragmentation

Contractors operate mixed fleets comprising multiple brands, rental units, and support equipment. - Rising Cost Sensitivity

Downtime, idle time, and maintenance inefficiencies now carry measurable financial penalties. - Digital Expectations

Construction firms increasingly expect the same data clarity found in logistics, mining, and manufacturing. - Competitive Digital Arms Race

Original Equipment Manufacturers (OEMs) are racing to control the digital layer that sits above physical equipment.

These dynamics clarify the impact of John Deere’s Tenna acquisition as a strategic necessity rather than an optional enhancement.

John Deere Smart Fleet Tools Enter a New Phase

Before the deal, John Deere smart fleet tools, such as the JDLink™, already supported equipment monitoring, diagnostics, and machine health insights. The Tenna acquisition expands that scope significantly.

Post-acquisition, John Deere can now offer:

- Unified fleet dashboards across brands.

- Enhanced data normalisation and analytics.

- Scalable fleet intelligence for large contractors.

- Improved integration between equipment, operators, and job sites.

This positions John Deere more competitively within the smart fleet management solutions segment.

Further Reading: 10 Powerful Insights: OEM vs Third-Party Maintenance Explained for Smarter Equipment Management

Tenna Fleet Tools for Construction Equipment Explained

The value of Tenna fleet tools for construction equipment lies in their practical, contractor-focused design.

Rather than overwhelming users with raw data, Tenna emphasises:

- Actionable insights on utilisation.

- Clear maintenance triggers.

- Compliance and inspection tracking.

- Operational transparency across job sites.

These features align closely with contractor priorities, making the acquisition strategically coherent rather than experimental.

John Deere Digital Construction Strategy Gains Depth

The John Deere digital construction strategy has evolved steadily over the past decade. Therefore, the Tenna acquisition accelerates this trajectory.

Key strategic outcomes include:

- Stronger software-first positioning.

- Reduced dependence on proprietary-only data ecosystems.

- Improved appeal to large, mixed-fleet contractors.

- Expanded recurring digital service opportunities.

The John Deere digital fleet management strategy now extends beyond equipment ownership into enterprise-level fleet optimisation.

Impact of John Deere Tenna Acquisition on the Market

The impact of the John Deere Tenna acquisition extends beyond John Deere’s customer base.

For Contractors

- Improved visibility across entire fleets.

- Reduced downtime through predictive maintenance.

- Better cost control and utilisation planning.

For Rental Companies

- Stronger asset tracking across dispersed fleets.

- Improved billing accuracy and utilisation rates.

For Competitors

- Increased pressure to accelerate digital investments.

- Reduced tolerance for closed or siloed telematics systems.

This ripple effect reshapes competitive dynamics across the construction equipment telematics market.

Digital Control Becomes a Competitive Advantage

The acquisition reinforces a critical industry reality. Control of digital infrastructure increasingly defines competitive advantage among OEMs.

In the past, machine performance differentiated brands. Today, data access, analytics, and integration increasingly influence purchasing decisions.

The John Deere Tenna acquisition strengthens Deere’s position in this emerging hierarchy, particularly against OEMs that still rely on fragmented or proprietary-only systems.

Industry Context: OEMs and Platform Strategy

Across the global construction sector, OEMs now face a strategic choice:

- Remain hardware-focused suppliers.

- Or evolve into integrated technology and service platforms.

The move to acquire Tenna places John Deere Construction Equipment firmly in the second category. This mirrors broader trends in industrial digitisation, where platforms increasingly capture long-term value.

From a strategic lens, John Deere’s smart fleet technology expansion aligns with how leading industrial firms protect relevance in data-driven markets.

Risks and Integration Challenges

Despite its strengths, the deal carries execution risks that will shape long-term outcomes.

Key challenges include:

- Seamless integration with existing John Deere digital tools.

- Maintaining Tenna’s platform-neutral credibility.

- Ensuring data security and customer trust.

- Aligning dealer networks with expanded digital offerings.

The success of the John Deere acquisition of the Tenna fleet platform narrative depends on disciplined integration rather than rapid monetisation.

What This Means for Contractors and Fleet Managers

For end users, the practical implications matter more than corporate strategy. Therefore, contractors adopting John Deere smart fleet tools enhanced by Tenna can expect:

- Better decision-making through consolidated data.

- Reduced administrative burden.

- Clearer visibility into true fleet costs.

- Improved planning across multiple projects.

These benefits address real operational pain points rather than abstract digital ambitions.

Further Reading: Proactive Equipment Care: Preventative Maintenance vs Reactive Maintenance in Construction Explained

Long-Term Outlook for Smart Fleet Management Solutions

The acquisition highlights where the industry is heading. Smart fleet management solutions will increasingly define equipment value propositions.

Over time, this shift may result in:

- Subscription-based digital services are becoming standard.

- Greater emphasis on interoperability.

- Data-driven performance benchmarking across fleets.

The John Deere digital fleet management strategy positions the company to remain competitive as this transition accelerates.

Conclusion: A Strategic Bet on Data, Not Just Machines

The John Deere Tenna acquisition stands as a clear statement of intent. John Deere recognises that future leadership in construction equipment will depend as much on data platforms as on iron and steel.

By integrating the Tenna fleet management platform into its ecosystem, John Deere strengthens its digital construction capabilities, expands smart fleet tools, and aligns itself with the evolving needs of modern contractors.

For the construction industry, this deal underscores a defining shift. Equipment manufacturers are no longer just builders of machines. They are architects of digital infrastructure that shapes how construction work gets done.

Stay Ahead of Digital Construction and Fleet Technology Trends

For thinker-led insights on construction equipment technology, digital fleet management, and industry strategy shaping Africa and global markets, explore more expert analysis at ConstructionFrontier.com.