20 Largest Construction Companies in Asia: Leaders Shaping the Industry

The largest construction companies in Asia are engineering the continent’s future; from futuristic cities and smart transport corridors to renewable energy networks and mega infrastructure projects. These firms are not only shaping Asia’s skylines; they are also redefining global construction standards through their scale, innovation, and sustainability.

Asia’s Construction Powerhouse: Building the Future at Unprecedented Scale

Asia’s construction industry is the most dynamic and fast-growing in the world, accounting for nearly 60% of global infrastructure spending. Across China, Japan, India, South Korea, and Southeast Asia, major construction firms are driving urban transformation, industrial growth, and sustainable development.

These companies deliver some of the world’s largest transport, energy, and housing projects, often serving as the backbone of national economies. From high-speed rail networks to smart cities and renewable energy plants, the region’s construction giants are shaping the built environment of the 21st century.

In this article, we rank the 20 largest construction companies in Asia, analysing their estimated revenues, specialisations, major projects, and leadership in innovation, digitalisation, and sustainability.

Methodology: How We Ranked Asia’s Construction Leaders

To determine Asia’s largest construction companies, this ranking considers:

- Revenue (latest 2025 estimates).

- Employee base and regional presence.

- Scale and complexity of infrastructure projects.

- Contribution to sustainable and smart construction.

- Reputation and market influence across Asia.

The Top 20 Largest Construction Companies in Asia

Below are the 20 largest construction companies in Asia. Let’s delve deeper by analysing their estimated 2025 revenue, specialisations, major infrastructural projects delivered, and how they are driving growth in the Asian construction industry.

1. China State Construction Engineering Corporation (CSCEC): Asia’s Construction Behemoth

Headquarters: Beijing, China

Founded: 1957

Estimated 2025 revenue: ~USD 315 billion

China State Construction Engineering Corporation (CSCEC) is the world’s largest construction company by revenue and the dominant force in Asia’s construction industry. It engages in building, infrastructure, real estate development, and contracting operations in more than 100 countries. Major projects include mega-airports, skyscrapers, urban regeneration, and transport hubs. This scale and scope make CSCEC the benchmark for leading infrastructure companies in Asia.

Major Projects:

- Shanghai Tower, China.

- Temburong Bridge, Brunei.

- PKM Motorway in Pakistan.

- Beijing Daxing International Airport, China.

- Hong Kong–Zhuhai–Macau Bridge, China.

- China Zun Tower, Beijing, China.

- Park Road Affordable Housing Project, Kenya.

Why They Lead:

CSCEC’s massive domestic market, global reach, and deep integration into China’s infrastructure strategy give it unmatched influence. It drives construction growth in Asia and sets international standards for scale, making it the prime example of leading construction and engineering companies in the region.

2. China Railway Group Limited (CREC): The Rail-and-Transit Specialist

Headquarters: Beijing, China

Founded: 1950

Estimated 2025 revenue: ~USD 160 billion

China Railway Group Limited (CREC) is one of China’s flagship contractors active in high-speed rail, metro systems, bridges, and tunnels across Asia and Africa. It plays a central role in Asia’s infrastructure development and urban transit expansion.

Major Projects:

- Jakarta-Bandung High-speed Railway, Indonesia.

- China-Laos Railway, China.

- Beijing-Shanghai High-speed Railway.

- National Ski Jumping Centre (“Snow Ruyi”), China.

- Fenghuangling Grand Bridge, China.

- High-speed rail network (38,000 km+), China.

Why They Lead:

With unrivalled experience in rail and transit infrastructure, CREC is a critical driver of urban mobility in Asia. Their technology and delivery model exemplify how construction growth in Asia is shifting from mere volume to high complexity.

3. China Railway Construction Corporation (CRCC): Connectivity Engine for Asia

Headquarters: Beijing, China

Founded: 1948

Estimated 2025 revenue: ~USD 145 billion

China Railway Construction Corporation (CRCC) specialises in railways, highways, urban transit, and major civil engineering projects. Its extensive cross-border project portfolio reinforces its role as a leading construction and engineering company in Asia.

Major Projects:

- Mecca-Medina Light Rail, Saudi Arabia.

- Addis Ababa-Djibouti Railway, Ethiopia.

- Dhaka Elevated Expressway, Bangladesh.

- Lusail Stadium, Qatar

- China-Laos Railway, including the Vientiane station.

Why They Lead:

Beyond volume, CRCC demonstrates how Asian firms are expanding their reach and expertise beyond domestic markets, shaping infrastructure networks across borders and fostering regional integration.

4. China Communications Construction Company (CCCC): Maritime, Port & Urban Infrastructure Leader

Headquarters: Beijing, China

Founded: 2005

Estimated 2025 revenue: ~USD 115 billion

China Communications Construction Company (CCCC) plays a central role in Asia’s maritime infrastructure, including major bridges and highways, particularly under the Belt and Road Initiative. It stands among the largest construction corporations in Asia thanks to its deep involvement in port-city projects and transport links. It is the parent company of China Road and Bridge Corporation (CRBC), with a significant presence in Africa.

Major Projects:

- Gwadar Port, Pakistan.

- Mombasa–Nairobi Standard Gauge Railway, Kenya.

- Phnom Penh-Sihanoukville Expressway, Cambodia.

- Maputo–Katembe Bridge, Mozambique.

- Hungary–Serbia Railway

- Lekki Deepwater Port in Nigeria.

- Hambantota Port in Sri Lanka.

- Hong Kong–Zhuhai–Macau Bridge.

Why They Lead:

By integrating port, bridge and highway development, CCCC exemplifies how infrastructure companies in Asia are scaling across multiple sectors, driving the region’s infrastructure wave.

5. China Energy Engineering Corporation (CEEC): Powering Asia’s Energy Transition

Headquarters: Beijing, China

Founded: 2011

Estimated 2025 revenue: ~USD 85 billion

China Energy Engineering Corporation (CEEC) combines large-scale infrastructure construction with the delivery of energy plants, making it essential for Asia’s transition to low-carbon power, hydro, and renewable energy sources.

Major Projects:

- Baihetan Hydropower Station, China

- Tekezé Hydropower Station, Ethiopia.

- Chashma Nuclear Power Plant, Pakistan.

- EREN SC Coal-fired Power Plant, Turkey.

- Laos hydropower projects, which include the Don Sahong Hydropower Station and the Nam E-meng Hydropower Project.

Why They Lead:

Construction today encompasses more than just concrete and steel; it also involves energy, sustainability, and integration. CEEC captures that evolution, representing how the Asian construction industry leaders are driving growth via energy infrastructure.

6. Hyundai Engineering & Construction (HDEC): South Korea’s Global Contractor

Headquarters: Seoul, South Korea

Founded: 1947

Estimated 2025 revenue: ~USD 55 billion

Hyundai Engineering & Construction (HDEC) operates globally with a strong presence in the Middle East, Asia-Pacific, and Latin America. Its expertise spans large civil works as well as infrastructure and energy.

Major Projects:

- Pacific Sunny Data Centre, South Korea.

- Suntec City complex, Singapore.

- Barakah Nuclear Plant (UAE).

- Panama Metro Line 3.

Why They Lead:

HDEC demonstrates that non-Chinese Asian firms continue to hold significant influence in the region. Its international footprint and advanced technical delivery place it firmly among the top construction firms in Asia.

7. Samsung C&T Corporation: Smart Buildings & Urban Innovation

Headquarters: Seoul, South Korea

Founded: 1938

Estimated 2025 revenue: ~USD 50 billion

Samsung C&T Corporation combines construction with development, focusing on skyscrapers, mixed-use urban projects, and smart-city infrastructure.

Major Projects:

- Burj Khalifa, Dubai.

- Taipei 101, Taiwan.

- Incheon Bridge, South Korea.

- Nairobi Traffic System, Kenya.

- Qatar Umm Al Houl desalination and power plant, Qatar.

- Major LNG facility, Qatar.

- Solar farm and low-carbon bioproducts plant, Qatar.

- Thomson-East Coast Line, Singapore.

Why They Lead:

As Asia’s built environment evolves, building shapes become more complex and digital. Samsung C&T is at the intersection of architecture, technology, and construction growth in Asia.

8. Kajima Corporation: Japan’s Engineering Pioneer

Headquarters: Tokyo, Japan

Founded: 1840

Estimated 2025 revenue: ~USD 37 billion

Kajima Corporation is one of Japan’s oldest and most established construction firms. Kajima leads in seismic-resistant design, smart urban renewals, and international civil works.

Major Projects:

- Core5, Vietnam.

- Karcher Centre Praha.

- Singapore (Mass Rapid Transit) MRT Extensions.

- Expo 2025 pavilions and sustainability zones, Osaka Kansai, Japan.

- Akita Noshiro offshore wind farm foundations, Japan.

Why They Lead:

Kajima’s strong focus on technical excellence and urban transformation makes it a leader in the construction industry, driving growth across Asia.

9. Obayashi Corporation: Sustainability and Green Building Innovator

Headquarters: Tokyo, Japan

Founded: 1892

Estimated 2025 revenue: ~USD 35 billion

Obayashi Corporation is recognised for its advanced green-building and carbon-neutral construction solutions, essential in a region striving for sustainable infrastructure.

Major Projects:

- Changi Airport Terminal 5, Singapore.

- Tokyo Station Redevelopment, Japan.

- Tokyo Skytree, Japan.

- Dubai Metro, UAE.

- Hoover Dam Bypass Bridge, U.S.A.

- Taiwan High Speed Rail, Taiwan.

Why They Lead:

As Asia’s construction market matures, sustainability becomes a differentiator. Obayashi leads the charge in eco-construction, making it one of the top construction firms in Asia in terms of influence and impact.

10. Shimizu Corporation: Future-Focused Engineering

Headquarters: Tokyo, Japan

Founded: 1804

Estimated 2025 revenue: ~USD 33 billion

Shimizu Corporation combines tradition with futuristic projects, the kind that define the next generation of infrastructure in Asia.

Major Projects:

- Haneda Airport Expansion, Japan.

- Tokyo Metropolitan Police Department Headquarters, Japan

- Sunshine 60 in Tokyo, Japan.

- Honshu-Shikoku Bridge, Japan.

- Novari innovation facility in Tokyo, Japan.

Why They Lead:

From fossil-free campuses to lunar-base research (yes, truly), Shimizu represents how Asian construction companies are pushing boundaries and redefining infrastructure.

11. Larsen & Toubro (L&T): India’s Infrastructure Engine

Headquarters: Mumbai, India

Founded: 1938

Estimated 2025 revenue: ~USD 30 billion

Larsen & Toubro (L&T) is India’s largest construction and engineering heavyweight, active in infrastructure, power, industrial, and defence sectors.

Major Projects:

- Mumbai-Ahmedabad High-Speed Rail (MAHSR), India.

- Dhubri-Phulbari Bridge (the longest river bridge in India), India.

- Navi Mumbai International Airport (NMIA), India.

- Defence Infrastructure, India.

- Pressurised Heavy Water Reactors (PHWR) and Light Water Reactors (LWR) in various Indian states.

Why They Lead:

India’s infrastructure push is enormous. L&T’s scale, reputation, and pan-Indian reach make it one of the leading construction companies in Asia and one of the top construction firms in the region.

12. China National Chemical Engineering Group Corporation (CNCEC): Industrial & Energy Construction Specialist

Headquarters: Beijing, China

Founded: 1953

Estimated 2025 revenue: ~USD 29 billion

China National Chemical Engineering Group Corporation (CNCEC) specialises in large-scale industrial and energy infrastructure projects, including refineries, petrochemical facilities, and renewable energy projects.

Major Projects:

- Hengyi PMB Refinery and Petrochemical Project, Brunei.

- Petronas RAPID Project, Malaysia.

- Kazakhstan’s largest petrochemical project.

- ABIC PCQ-2 tank farm and the SADAF EOP, Saudi Arabia.

- Hubei Green Hydrogen Project, China.

Why They Lead:

As Asia advances industrialisation, construction growth in Asia requires heavy-industry expertise. CNCEC fills that niche and leads in that domain in energy and other major infrastructural projects.

13. Daiwa House Industry Co., Ltd.: Japan’s Residential and Urban Builder

Headquarters: Osaka, Japan

Founded: 1955

Estimated 2025 revenue: ~USD 28 billion

Daiwa House Industry Co., Ltd. specialises in modular housing, smart town development, and industrial facilities in Japan and overseas.

Major Projects:

- Habikino Neopolis, Japan.

- Okayama Neopolis, Japan.

- Box Hill Project in Sydney, Australia.

- DPL Sakaido 2 Project, Japan.

- DREAM Solar Project, Japan.

- NEDO Green Innovation Fund Project, Japan.

Why They Lead:

Although not purely mega-infrastructure, Daiwa House is essential to Asia’s built environment story, particularly in urban housing, industrial park construction, and smart city growth.

14. China Metallurgical Group Corporation (MCC): Mining & Industrial Infrastructure Driver

Headquarters: Beijing, China

Founded: 1982

Estimated 2025 revenue: ~USD 26 billion

China Metallurgical Group Corporation (MCC) integrates construction with metal-industry infrastructure, mines, processing plants, and large-scale industrial zones.

Major Projects:

- Las Bambas Copper Mine infrastructure, Peru.

- Universal Beijing Resort, China.

- New Phnom Penh International Airport, Cambodia.

- Yulin Fumian Airport, China.

- Ramu Nickel-Cobalt Project, Papua New Guinea.

- Hospital construction, Kuwait.

Why They Lead:

Asia’s rise is not just about buildings and roads; it’s about the underlying industrial infrastructure that supports them. MCC plays a crucial role in this less-visible but vital domain.

15. Taisei Corporation: Japan’s Urban Infrastructure Specialist

Headquarters: Tokyo, Japan

Founded: 1873

Estimated 2025 revenue: ~USD 25 billion

Taisei Corporation is an expert in tunnels, underground works, airport expansions, and urban transport infrastructure across the Asia-Pacific region.

Major Projects:

- Hamad International Airport Passenger Terminal Complex, Qatar.

- Underwater Vehicular Tunnel for the Palm Jumeirah, Dubai.

- Improvement Plan for Shimbashi Station, Tokyo.

- National Highway N-70 Improvement Project, Pakistan.

Why They Lead:

Urban infrastructure in Asia is evolving, featuring tunnels, underground networks, and integrated transportation systems. Taisei excels in this niche and ranks among the largest construction companies in Asia in terms of influence.

16. Sinohydro Corporation: Hydropower & Renewable Infrastructure Leader

Headquarters: Beijing, China

Founded: 1950

Estimated 2025 revenue: ~USD 22 billion

Sinohydro Corporation focuses on hydropower dams, renewable water-power projects, and energy infrastructure across Asia and Africa.

Major Projects:

- Lower Sesan 2 Dam, Cambodia.

- Xiluodu Hydropower Project, China.

- Bakun Hydropower Plant, Malaysia.

- Standard Gauge Railway, Kenya.

- Ranomafana Hydroelectricity Power Plant, Madagascar.

Why They Lead:

As construction growth in Asia shifts toward renewable infrastructure, companies like Sinohydro are gaining prominence. They highlight how infrastructure development in Asia is evolving in sector content.

17. Gammon Construction: Hong Kong’s Engineering Icon

Headquarters: Hong Kong

Founded: 1919

Estimated 2025 revenue: ~USD 8.5 billion

Gammon Construction delivers major civil and infrastructure works in Hong Kong and Southeast Asia.

Major Projects:

- Hong Kong International Airport Tunnels for the Three Runway System, Hong Kong.

- Central Kowloon Route tunnel buildings, Hong Kong.

- E&M works in Hong Kong, Macao, Pakistan, Zambia, and India.

- Tuen Mun–Chek Lap Kok Link Southern Connection Viaduct, Hong Kong.

- Havelock and Mayflower stations, Singapore.

- Thomson Line and the Sentosa cableway stations, Singapore.

- Central-Wan Chai Bypass, Hong Kong.

Why They Lead:

Smaller in revenue than the giants above, but Gammon’s reputation for complex engineering in constrained urban environments makes it an important regional player in the list of top construction firms in Asia.

18. Sumitomo Mitsui Construction Co.: Smart Infrastructure Innovator

Headquarters: Tokyo, Japan

Founded: 1953

Estimated 2025 revenue: ~USD 9 billion

Sumitomo Mitsui Construction specialises in innovative infrastructure solutions, seismic-resilient urban development, and integrated transport systems.

Major Projects:

- Neste Singapore Expansion Project is a sustainable aviation fuel manufacturing plant in Singapore.

- New Bridge Construction Project over the Kelani River, Sri Lanka.

- Metro Manila Subway and the North-South Commuter Railway, Philippines.

- Smart-bridge projects (Dura Bridge and Washimibashi Bridge), Japan.

- Collaborated on the Bangkok MRT Purple Line, Thailand.

Why They Lead:

While smaller in scale, their focus on innovative and resilient infrastructure puts them squarely among the emerging leaders of Asia’s next-phase construction industry.

19. Penta‑Ocean Construction Co., Ltd.: Marine & Coastal Specialist

Headquarters: Tokyo, Japan

Founded: 1896

Estimated 2025 revenue: ~USD 6.5 billion

Penta-Ocean Construction is a specialist in marine works, land reclamation, port-city projects, and offshore construction across Asia.

Major Projects:

- Changi East Airport Expansion tunnels, Singapore.

- The construction of the nuclear power plant in Harbours, Japan.

- Thomson-East Coast Line (MRT) and the Rapid Transit System (RTS) Link, Singapore.

- The construction of a heavy lift vessel (HLV) for offshore wind farm development in Japan.

- Tuas Terminal reclamation, Singapore.

- Sengkang Hospital, Singapore.

Why They Lead:

As Asian infrastructure diversifies into ports, coastal defences, and offshore energy, Penta-Ocean’s niche expertise becomes critical to the overall growth of the construction industry in Asia.

20. Gamuda Berhad: Malaysia’s Regional Infrastructure Champion

Headquarters: Selangor, Malaysia

Founded: 1976

Estimated 2025 revenue: ~USD 5.8 billion

Gamuda Berhad is one of Southeast Asia’s most progressive infrastructure groups, actively involved in rail, tunneling, and urban redevelopment.

Major Projects:

- Penang LRT Mutiara Line and MRT Line 2, Malaysia.

- Xizhi Donghu MRT, Taiwan.

- SMART Tunnel and Electrified Double Track Project, Malaysia.

- Gamuda Cove property developments, Malaysia.

- Sydney Metro West- Western Tunnelling Package (via joint ventures), Australia.

Why They Lead:

It rounds out the list by demonstrating that the largest construction companies in Asia are not just Chinese or Japanese: regional firms like Gamuda drive infrastructure growth across Southeast Asia and reflect the broad base of the industry’s expansion.

Summary Table: 20 Largest Construction Companies in Asia (2025 Ranking by Influence & Revenue)

| Rank | Company | Country | Estimated 2025 Revenue (USD ≈) | Specialisation | Notable Projects |

| 1 | China State Construction Engineering Corporation (CSCEC) | China | 315 billion | Buildings & infrastructure | Shanghai Tower, China.

Temburong Bridge, Brunei. PKM Motorway in Pakistan. |

| 2 | China Railway Engineering Corporation (CREC) | China | 160 billion | Rail & transport infrastructure | Jakarta-Bandung High-speed Railway, Indonesia.

China-Laos Railway, China. Beijing-Shanghai High-speed Railway. |

| 3 | China Railway Construction Corporation (CRCC) | China | 145 billion | Rail, highways, urban transit | Mecca-Medina Light Rail, Saudi Arabia.

Addis Ababa-Djibouti Railway, Ethiopia. Dhaka Elevated Expressway, Bangladesh |

| 4 | China Communications Construction Company (CCCC) | China | 115 billion | Ports, bridges, and highways | Gwadar Port, Pakistan.

Mombasa–Nairobi Standard Gauge Railway, Kenya. Phnom Penh-Sihanoukville Expressway, Cambodia. Maputo–Katembe Bridge, Mozambique. |

| 5 | China Energy Engineering Corporation (CEEC) | China | 85 billion | Energy & infrastructure | Baihetan Hydropower Station, China

Tekezé Hydropower Station, Ethiopia. Chashma Nuclear Power Plant, Pakistan. |

| 6 | Hyundai Engineering & Construction (HDEC) | South Korea | 55 billion | Civil & offshore works | Pacific Sunny Data Centre, South Korea.

Suntec City complex, Singapore. Barakah Nuclear Plant (UAE). |

| 7 | Samsung C&T Corporation | South Korea | 50 billion | Smart buildings & urban works | Burj Khalifa, Dubai.

Taipei 101, Taiwan. Incheon Bridge, South Korea. |

| 8 | Kajima Corporation | Japan | 37 billion | Urban engineering & redevelopment | Core5, Vietnam.

Karcher Centre Praha. Singapore (Mass Rapid Transit) MRT Extensions |

| 9 | Obayashi Corporation | Japan | 35 billion | Sustainable construction | Changi Airport Terminal 5, Singapore.

Tokyo Station Redevelopment, Japan. Tokyo Skytree, Japan. |

| 10 | Shimizu Corporation | Japan | 33 billion | Future-facing infrastructure | Haneda Airport Expansion, Japan.

Tokyo Metropolitan Police Department Headquarters, Japan Sunshine 60 in Tokyo, Japan. |

| 11 | Larsen & Toubro (L&T) | India | 30 billion | Infrastructure & engineering | Mumbai-Ahmedabad High-Speed Rail (MAHSR), India.

Dhubri-Phulbari Bridge (the longest river bridge in India), India. Navi Mumbai International Airport (NMIA), India. |

| 12 | China National Chemical Engineering Group (CNCEC) | China | 29 billion | Industrial & energy construction | Hengyi PMB Refinery and Petrochemical Project, Brunei.

Petronas RAPID Project, Malaysia. Kazakhstan’s largest petrochemical project. |

| 13 | Daiwa House Industry Co. | Japan | 28 billion | Housing & industrial parks | Habikino Neopolis, Japan.

Okayama Neopolis, Japan. Box Hill Project in Sydney, Australia. |

| 14 | Metallurgical Corporation of China (MCC) | China | 26 billion | Industrial & mining infrastructure | Las Bambas Copper Mine infrastructure, Peru.

Universal Beijing Resort, China. New Phnom Penh International Airport, Cambodia. |

| 15 | Taisei Corporation | Japan | 25 billion | Tunnels & transport infrastructure | Hamad International Airport Passenger Terminal Complex, Qatar.

Underwater Vehicular Tunnel for the Palm Jumeirah, Dubai. Improvement Plan for Shimbashi Station, Tokyo. |

| 16 | Sinohydro Corporation | China | 22 billion | Hydropower & renewable infrastructure | Lower Sesan 2 Dam, Cambodia.

Xiluodu Hydropower Project, China. Bakun Hydropower Plant, Malaysia. |

| 17 | Gammon Construction | Hong Kong | 8.5 billion | Civil & constrained urban works | Hong Kong International Airport Tunnels for the Three Runway System, Hong Kong.

Central Kowloon Route tunnel buildings, Hong Kong. E&M works in Hong Kong, Macao, Pakistan, Zambia, and India. |

| 18 | Sumitomo Mitsui Construction Co. | Japan | 9 billion | Smart infrastructure & resilience | Neste Singapore Expansion Project is a sustainable aviation fuel manufacturing plant in Singapore.

New Bridge Construction Project over the Kelani River, Sri Lanka. Metro Manila Subway and the North-South Commuter Railway, Philippines. |

| 19 | Penta-Ocean Construction Co. | Japan | 6.5 billion | Marine & offshore infrastructure | Changi East Airport Expansion tunnels.

The construction of the nuclear power plant in Harbours, Japan. Thomson-East Coast Line (MRT) and the Rapid Transit System (RTS) Link, Singapore. |

| 20 | Gamuda Berhad | Malaysia | 5.8 billion | Rail, tunnelling & urban redevelopment | Penang LRT Mutiara Line and MRT Line 2, Malaysia.

Xizhi Donghu MRT, Taiwan. SMART Tunnel and Electrified Double Track Project, Malaysia. |

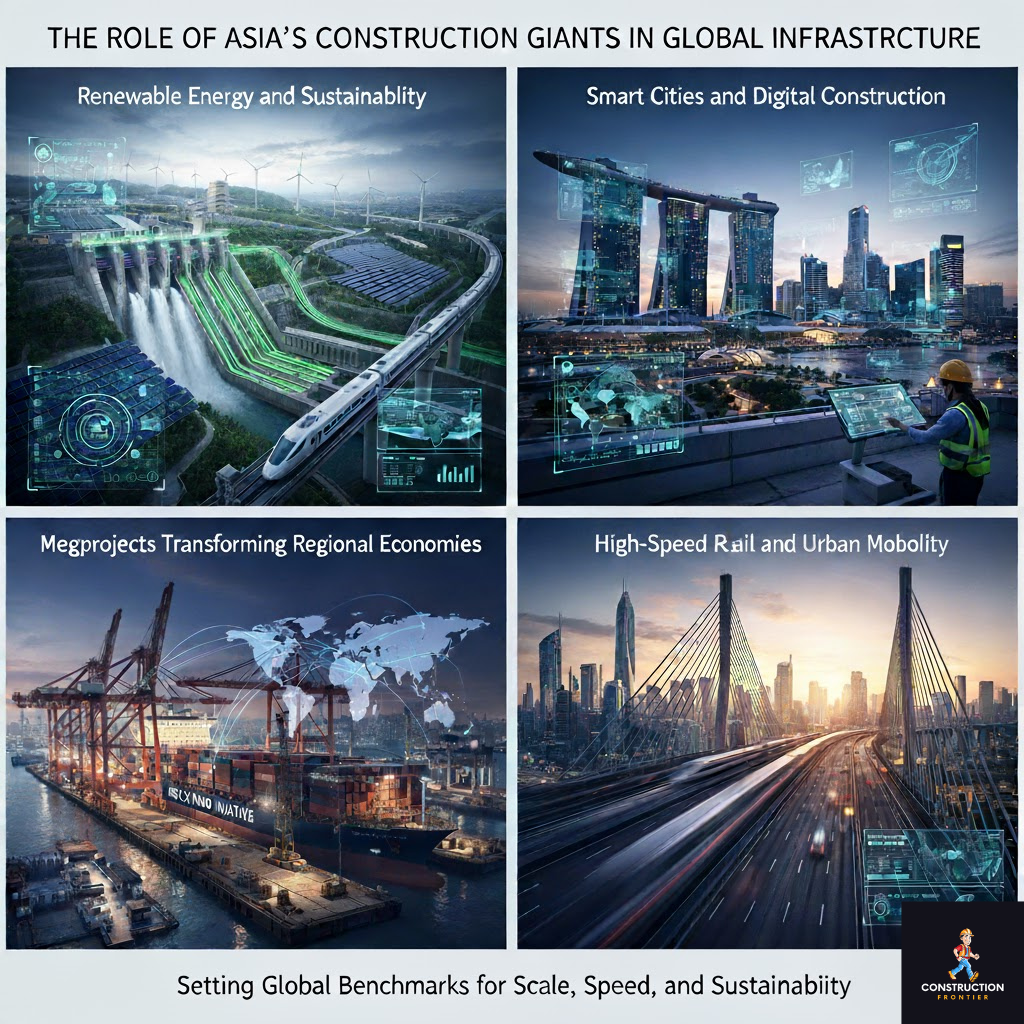

The Role of Asia’s Construction Giants in Global Infrastructure

The largest construction companies in Asia are redefining the global infrastructure landscape through large-scale innovation, international partnerships, and groundbreaking engineering achievements. From the world’s longest bridges to next-generation smart cities, the Asia construction industry continues to set global benchmarks for scale, speed, and sustainability. These firms not only build within their home markets but also export technology, expertise, and talent to projects spanning Africa, the Middle East, and Europe.

1. High-Speed Rail and Urban Mobility

Asia leads the world in high-speed rail and urban transit development, a cornerstone of sustainable infrastructure growth. Companies like China Railway Engineering Corporation (CREC) and China Railway Construction Corporation (CRCC) have delivered record-breaking projects such as the Jakarta–Bandung and China–Laos high-speed railways, boosting regional connectivity.

Japan’s Shinkansen (Bullet train) system remains a global model for precision, safety, and punctuality, inspiring emerging rail projects across India, Indonesia, and Thailand. The continent’s investment in metro systems, electric buses, and intercity rail links reflects a broader push towards low-carbon, high-capacity mobility solutions.

2. Smart Cities and Digital Construction

The smart city revolution is at the heart of modern Asian infrastructure development. Industry leaders such as Samsung C&T, Larsen & Toubro, and Kajima Corporation are integrating AI, IoT, BIM (Building Information Modelling), and digital twin technology into their design and construction processes.

This digitalisation is transforming urban environments, as seen in Singapore’s Marina Bay, Seoul’s incorporation of smart housing in various districts with initiatives like the “Moa Housing“, and Tokyo’s current autonomous transport zones tests. By embracing data-driven planning and automation, Asia’s builders are shaping cities that are efficient, resilient, and sustainable, setting new standards for digital construction in Asia.

3. Renewable Energy and Sustainability

Asia’s rapid shift towards renewable energy is reshaping its construction priorities and driving sustainable infrastructure development. Powerhouses such as China Energy Engineering Corporation (CEEC), Sinohydro, and Obayashi Corporation are pioneering the design and delivery of solar, wind, and hydroelectric megaprojects.

From China’s Baihetan Hydropower Station to Japan’s floating solar parks and India’s green hydrogen plants, the focus is on aligning with national net-zero targets and the Paris Climate Agreement. Green construction methods, green eco-friendly building materials, and low-emission technologies are becoming standard practice, reinforcing Asia’s leadership in sustainable construction.

4. Megaprojects Transforming Regional Economies

The Belt and Road Initiative (BRI) continues to position Asia as the central hub of global infrastructure connectivity. Chinese and Indian firms are spearheading multi-billion-dollar megaprojects in transportation, logistics, and energy that connect Asia with Africa, Europe, and the Middle East.

Projects such as the Port City Colombo, China–Pakistan Economic Corridor, and Mumbai Trans Harbour Link demonstrate how infrastructure fuels trade, investment, and employment. These initiatives strengthen Asia’s role as the engine of global development, supported by advanced financing, engineering innovation, and cross-border collaboration.

Future Trends in Asia’s Construction Industry

The future of the Asian construction industry is defined by sustainability, digitalisation, and cross-regional expansion. With governments investing heavily in urban resilience and smart infrastructure, Asia’s leading firms are expected to continue dominating the global market in the next decade. The following are key trends shaping the construction industry across the region.

1. Green Building Standards

Asia’s construction companies are increasingly adhering to international green building standards such as LEED, BREEAM, and Singapore’s Green Mark. Developers such as Taisei Corporation and Kajima are setting examples through energy-efficient designs, the use of recycled materials, and reduced carbon footprints. The integration of sustainable architecture into commercial, residential, and industrial projects demonstrates how environmental responsibility has become a competitive advantage in the Asia construction market.

2. Digitalisation and Automation

Digitalisation in construction is accelerating across Asia, driven by AI-based project management, innovative new construction technologies such as robotics, modular construction, and 3D printing. Countries like Japan and South Korea are pioneering automated building techniques that reduce waste, enhance precision, and lower costs. Meanwhile, China and India are investing in construction technology start-ups and digital skills training, ensuring that automation in construction becomes a driver of long-term productivity and innovation.

3. Regional Expansion

Asia’s major contractors are expanding their influence beyond domestic borders, pursuing contracts in Southeast Asia, the Middle East, and Africa. Firms such as L&T, Samsung C&T, and China Communications Construction Company (CCCC) are leveraging their technical expertise and financial strength to compete on international projects. This regional expansion not only boosts Asia’s construction exports but also strengthens global collaboration, making the continent a key contributor to the world’s infrastructure development pipeline.

Conclusion: Asia’s Builders of the Future

The largest construction companies in Asia are more than industry players; they are the architects of global progress. Their projects define skylines, connect nations, and drive sustainable development from the deserts of the Middle East to the jungles of Southeast Asia. Through scale, innovation, and environmental responsibility, Asia’s engineering leaders are setting the pace for the next generation of global infrastructure.

From China’s high-speed rail corridors and India’s urban redevelopment initiatives to Japan’s green innovations and Korea’s smart cities, top construction firms in Asia are shaping not just the continent’s future but the world’s. As the demand for sustainable, high-tech infrastructure continues to grow, these firms will remain at the forefront, driving the evolution of the global construction industry for decades to come.

Call to Action: Stay Informed with Construction Frontier

Want to stay updated on the latest developments shaping Asia’s construction landscape? Visit ConstructionFrontier.com; your trusted source for industry insights, infrastructure analysis, and global construction trends driving the future of development.