Kenya Cement Market: Strong Growth Outlook 2026–2030

The Kenya cement market faces structural supply constraints, rising energy costs, and fluctuating clinker imports, all of which directly affect construction timelines and budgets. Cement prices in Kenya surged after intermittent shortages in 2025, highlighting vulnerabilities in production, logistics, and financing. This article examines pricing trends, the causes of cement shortages in Kenya, manufacturer strategies, and a data-driven outlook for 2026–2030, offering actionable insights for contractors, developers, and industrial investors.

Introduction: Why the Kenya Cement Market Matters for Industrial Leaders

Kenya remains one of East Africa’s most critical markets for construction materials. Cement serves as a bellwether for construction momentum, the health of the infrastructure pipeline, and financing viability. Unlike headline measures of capacity, real-world supply reliability determines project outcomes. Manufacturers, contractors, quantity surveyors, financiers, and policymakers need a granular view of how prices are set, which structural tensions persist, and how the market will evolve over the next several years.

In 2024, cement production and consumption both contracted by around 7% amid a construction sector slowdown and reduced clinker imports. Production in 2025 recovered strongly year-on-year, with half-year output and consumption rising by double digits. These swings reflect deeper structural dynamics that will shape industry decisions through 2026 and beyond.

This analysis breaks down the real structure of the Kenya cement market, explains why cement shortages in Kenya keep recurring, examines the mechanics of price formation, and presents a scenario-based outlook for 2026 to 2030 grounded in industrial fundamentals rather than headlines.

Kenya Cement Market Structure and Dynamics

This section explains how the Kenya cement market operates at a system level, including capacity, raw material flows, and output patterns. It sets the context for pricing and supply patterns.

Since the early 2000s, Kenya has expanded cement capacity both through greenfield plants and increased grinding facilities. The industry’s installed capacity exceeds current domestic consumption, but effective production and supply rarely reach theoretical peaks. Structural constraints such as clinker availability, energy costs, and maintenance cycles prevent utilisation from fully reflecting nameplate capacity.

Despite excess theoretical capacity, the market still experiences regional shortages and supply stress during peak demand. These outcomes arise not from plant scarcity but from logistical bottlenecks, raw material flows, and producer strategies that prioritise margin stability over volume.

Installed Capacity and Industry Participants

Kenya’s cement production ecosystem comprises integrated producers and grinding facilities. According to Oxford Business Group, recent industry estimates, total installed cement capacity stood at over 12 million tonnes per annum, supported by a mix of heritage and emerging producers. The leading firms include Bamburi Cement, National Cement/Simba, Mombasa Cement, Savannah Cement, East African Portland Cement, and smaller players.

Effective utilisation fluctuates between 55% and 70% depending on energy prices, plant downtime, and balance sheet health. Despite capacity growth, total clinker capacity remains constrained relative to grinding potential. Integrated producers with clinker lines benefit from cost control, while grinding-only plants depend on imported clinker, exposing them to FX and port risks. To counter clinker shortages in East Africa and Kenya, Devki Group (National Cement) aims to produce and export 80% of its clinker output to neighbouring countries such as Rwanda, Burundi, and Uganda through its new West Pokot plant.

Kenyan Cement Capacity: Summary Table

| Metric | Estimate |

| Installed capacity | 12–13 million tonnes |

| Annual consumption (2024–2025) | 7–8 million tonnes |

| Capacity utilisation | 55–70% |

| Clinker import share | 35–45% |

Clinker Economics and Import Dependence

Clinker accounts for the bulk of the cost base in cement manufacturing because energy and processing drive prices. Kenya’s clinker import volumes collapsed by 93 per cent in 2024 relative to 2023, falling from around 148,000 tonnes to just over 10,000 tonnes, as manufacturers sought to incentivise domestic production and reduce Foreign Exchange (FX) exposure.

Policy changes such as the export and investment levy on imported clinker aim to protect domestic producers and encourage backward integration; however, reduced import flows also tightened supply and pressured local raw material availability.

Production and Consumption Trends

Data from the Kenya National Bureau of Statistics (KNBS) shows divergent performance between 2024 and 2025. Cement production declined in 2024 from 9.6 million tonnes to 8.9 million tonnes, a 7 per cent contraction, while consumption contracted similarly. This mirrored slower construction sector growth amid financing constraints.

In contrast, the first half of 2025 saw production grow by 17.3% to approximately 4.85 million tonnes, while consumption jumped 22.1% to around 4.76 million tonnes, the strongest half-year performance in several years. Output exceeded 800,000 tonnes per month consistently between March and June 2025. These performance swings highlight the cyclicality of cement demand, linked to public and private construction rollouts and funding execution.

Further Reading: Devki Sh13.7bn Deal Sees Takeover of Rwanda Cement Firm

Cement Prices in Kenya: Formation, Drivers and Trends

Understanding cement prices in Kenya requires a granular view of the cost base, market behaviour, and economic forces that cascade into the retail prices contractors pay.

Cement prices reflect energy inputs, logistics and distribution costs, foreign-exchange exposure on key raw materials such as clinker, and demand pressure during peak construction periods. Prices have stabilised recently after historic spikes in 2022 and 2023, but the structural cost base remains higher than pre-pandemic levels.

Cement Price Ranges (2023–2025)

| Cement Type | Typical Retail Price (KES/50kg) |

| Ordinary Portland Cement (OPC) | 700–900 |

| Portland Pozzolana Cement (PPC) | 650–850 |

| Bulk cement (contractor supply) | 12,000–15,000 per tonne |

Current Price Benchmarks and Regional Variance

In Nairobi, the average 50kg bag of cement traded at around KES 750 in mid-2025. Brand and grade variations range between KES 735 and KES 1,350, reflecting different product segments and market positioning.

This urban benchmark masks sharper regional variances. In remote counties, distribution costs increase prices by 5% to 15% due to longer hauls and higher fuel consumption. Given cement’s low value-to-weight ratio, transport costs account for a significant share of the final price.

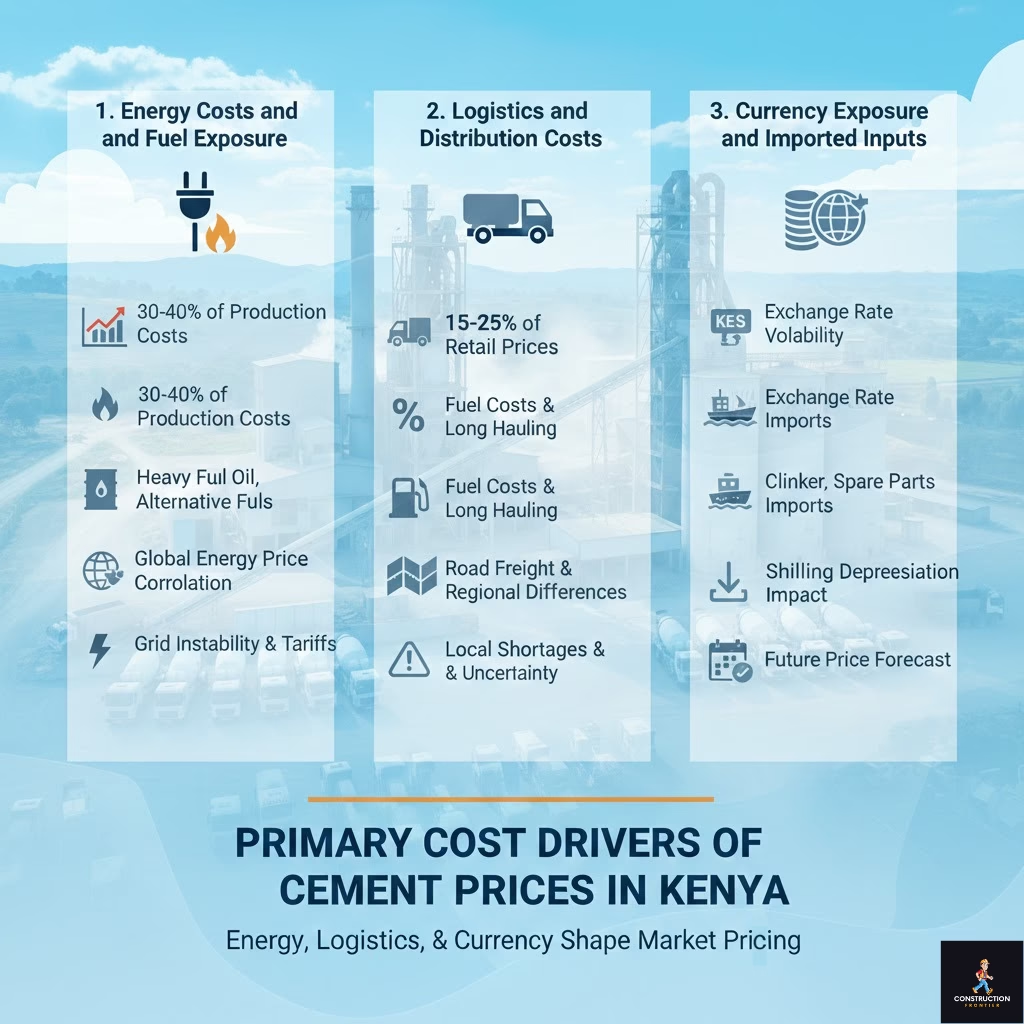

Primary Cost Drivers of Cement Prices in Kenya

Cement prices in Kenya reflect structural production and distribution costs rather than short-term demand swings. Energy, logistics, and currency exposure are the core pricing drivers in the Kenya cement market, creating long-term price rigidity and limiting downward price flexibility even during demand slowdowns.

1. Energy Costs and Fuel Exposure

Energy accounts for roughly 30% to 40% of cement production costs in Kenya. Producers depend on heavy fuel oil, electricity, and alternative fuels to run kilns and grinding operations. When global energy prices rise, cement prices in Kenya adjust quickly as manufacturers protect margins. When global coal prices surged in 2022, local cement prices followed suit. Grid instability and rising power tariffs continue to elevate baseline costs, reinforcing persistent price pressure across the Kenyan construction materials market.

2. Logistics and Distribution Costs

Transport contributes 15% to 25% of retail cement prices, driven by fuel costs, long-distance hauling, and road enforcement constraints. Heavy reliance on road freight explains regional price differences across counties. These logistics pressures exacerbate cement shortages at the local level in Kenya and introduce cost uncertainty for contractors operating outside major urban centres.

3. Currency Exposure and Imported Inputs

The Kenya cement market remains exposed to exchange rate volatility due to clinker imports, spare parts, and equipment priced in foreign currency. Shilling depreciation immediately increases cement production costs, forcing price adjustments even when demand weakens. This exposure plays a central role in shaping Kenya’s cement market pricing trends and the cement price forecast for Kenya 2026.

Price Comparison Table: 2025 Brand Benchmarks

| Brand | Grade | Average Price (KES/50kg) |

| Simba | 32.5 R | 735 |

| Rhino | 42.5 N | 750 |

| Bamburi Fundi | 42.5 | 780 |

| Bamburi Tembo | 42.5 | 800 |

| Bamburi Nguvu | 42.5 | 855 |

| Bamburi Powermax | Premium | 1350 |

Source: Market reporting and KNBS data synthesis

This table demonstrates that quality and brand positioning shape pricing tiers alongside cost drivers.

Further Reading: Top 7 Best Cement Companies in Kenya for Quality and Reliability

Cement Shortages in Kenya: Structural Causes, Not Temporary Disruptions

Cement shortages in Kenya reflect deep-seated structural weaknesses within the industry rather than cyclical demand fluctuations. Despite installed production capacity exceeding domestic demand in theory, the Kenyan cement market continues to experience intermittent supply constraints. These shortages directly affect cement prices in Kenya, disrupt construction schedules, and increase cost uncertainty across the Kenyan construction materials market.

Despite the limitations, the Kenyan cement capacity is expected to rise with new players such as the Devki Group’s Cemtech Ltd subsidiary. The underlying drivers cut across clinker supply, energy economics, producer financial health, and logistics concentration, creating systemic vulnerability rather than isolated failures.

1. Clinker Import Dependency and Foreign Exchange Risk

The Kenya cement market relies heavily on imported clinker, particularly for grinding-only plants without integrated kiln capacity. Most clinker enters through Mombasa Port, exposing producers to foreign exchange volatility, shipping delays, and port congestion. Dollar liquidity constraints frequently delay clinker procurement, reducing plant utilisation rates even when market demand remains strong. This structural dependency explains recurring cement shortages in Kenya despite apparent excess capacity.

2. Energy Cost Volatility and Production Instability

Energy remains one of the most significant cost components in cement manufacturing. Grid instability, rising electricity tariffs, and fuel price fluctuations force producers to reduce kiln operating hours or temporarily idle capacity. These disruptions lower adequate supply and tighten availability during peak construction periods, reinforcing price sensitivity within the Kenya cement market.

3. Financial Stress Among Cement Producers

Balance sheet pressure among several manufacturers constrains working capital, maintenance spending, and clinker procurement. Financial distress reduces operational flexibility, inflates downtime risk, and limits the ability to scale production during demand surges. As a result, installed capacity figures often overstate deliverable supply within the cement industry in Kenya.

4. Infrastructure Demand Concentration and Distribution Bottlenecks

Large public infrastructure projects in Kenya cluster cement demand geographically and temporally, overwhelming regional distribution networks. Even when national production remains stable, localised shortages emerge due to transport constraints and limited buffer storage. This mismatch between centralised production and decentralised consumption exacerbates cement shortages at the project level in Kenya.

Further Reading: 65 Affordable Housing Projects in Kenya: Transforming Urban Living for All

Supply versus Demand in 2024 and 2025

The Kenya cement market experienced a clear demand-led contraction in 2024, closely tracking reduced construction activity across both public infrastructure and private real estate. Cement consumption fell by approximately 7%, declining from about 9.1 million tonnes to 8.5 million tonnes, as delayed government payments, tighter credit conditions, and stalled private developments slowed material off-take. This contraction highlighted the sensitivity of cement demand to project financing rather than structural overcapacity in Kenya’s cement industry, according to data from Global Cement.

The rebound in 2025 proved equally instructive. During the first half of the year, cement production rose by more than 17%, while consumption increased by over 22%, reflecting renewed project execution once funding flows stabilised and delayed works resumed. This rapid recovery reinforced a key structural insight for the Kenya construction materials market: cement demand responds quickly when capital deployment aligns with project readiness, even after periods of sharp slowdown. For contractors and suppliers, these dynamics underscore why short-term demand weakness should not be misread as long-term market decline.

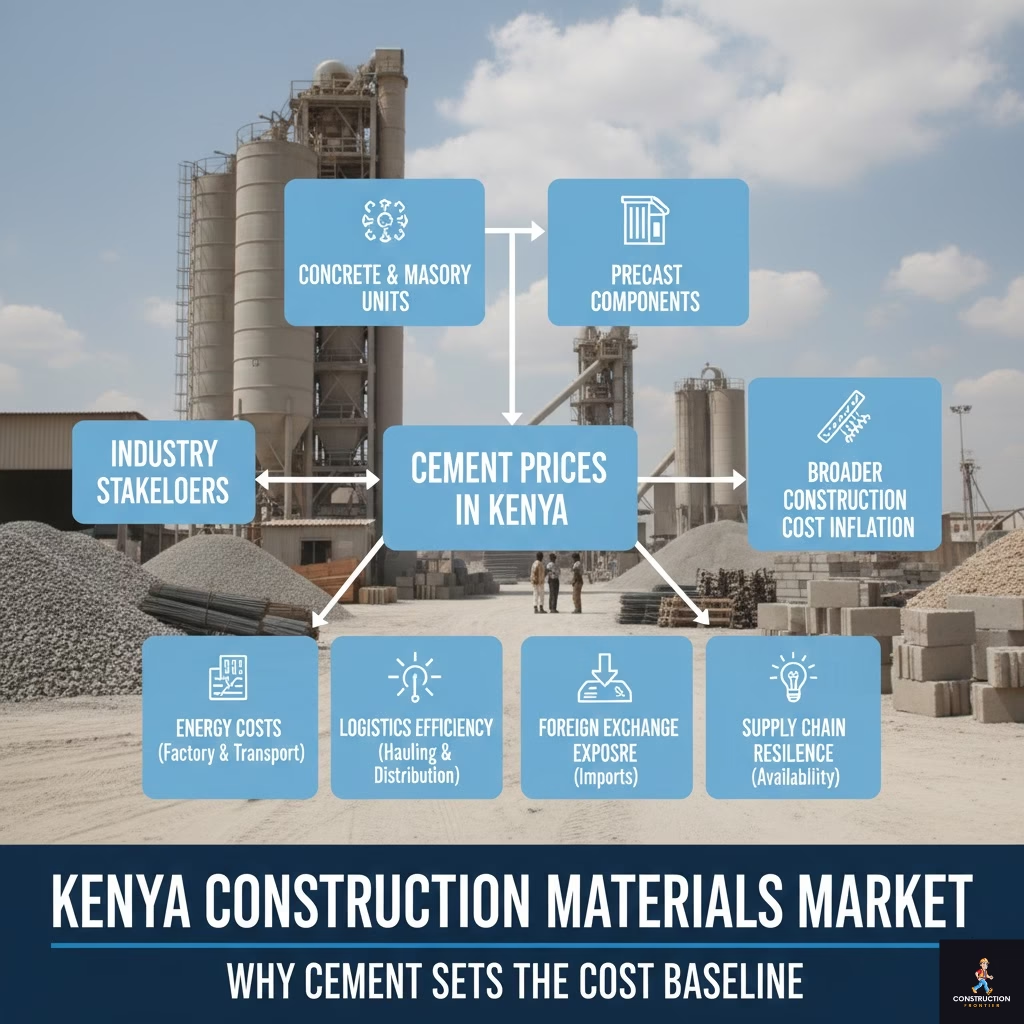

Kenya Construction Materials Market: Why Cement Sets the Cost Baseline

The Kenyan construction materials market revolves around cement as its primary price-setting input. No other material influences construction costs, procurement strategies, and project feasibility as consistently as cement. Cement prices in Kenya directly shape the cost of concrete, masonry units, precast components, and ready-mix products, making the Kenya cement market a leading indicator for broader construction cost inflation.

Industry stakeholders track cement pricing because it reflects energy costs, logistics efficiency, foreign exchange exposure, and supply chain resilience in a single metric. When cement prices shift, they signal bigger structural changes across the cement industry in Kenya and the broader building materials ecosystem.

How Cement Prices Cascade Through Construction Costs

Cement price fluctuations quickly impact downstream materials. Quantity surveying benchmarks with the Kenya National Bureau of Statistics show that a 10% increase in cement prices in Kenya raises reinforced concrete costs by 4%–6%, depending on transport distance, aggregate sourcing, and mix specifications. Ready-mix suppliers adjust pricing almost immediately, while block and precast manufacturers face margin erosion unless they pass costs through to contractors.

Residential and low-rise commercial projects are most affected. These developments rely heavily on cement-intensive elements such as foundations, slabs, blockwork, screeds, and plastering. As a result, fluctuations in the Kenya cement market disproportionately affect housing affordability and small-to-medium construction firms operating within the Kenya construction materials market.

Implications for Contractors, Developers, and Financiers

Cement pricing now functions as a systemic risk variable, not a static cost input. Contractors working under fixed-price contracts face margin pressure during periods of cement shortages in Kenya or rapid price escalation. Developers respond by delaying project starts, redesigning structural systems, or renegotiating supplier terms.

For lenders and investors, cement price volatility influences project bankability assessments, cost contingency allowances, and funding disbursement schedules. Persistent instability within the Kenya cement market, therefore, reshapes how stakeholders price risk across the entire construction value chain. In effect, cement does not merely contribute to construction costs in Kenya; it defines the cost baseline against which all other materials, margins, and project decisions align.

Top Cement Manufacturers in Kenya and Africa

The Kenya cement market sits at the intersection of regional competition, rising production costs, and shifting demand dynamics. Kenya hosts a mix of legacy producers and aggressively expanding private players, all operating within a tightening cost environment shaped by energy prices, clinker availability, and logistics efficiency. As the cement industry in Kenya evolves toward 2026, competitive positioning increasingly depends on vertical integration, operational resilience, and capital discipline, rather than sheer installed capacity.

Best Cement Manufacturers in Kenya (2026 Positioning)

| Manufacturer | Strategic Position |

| Bamburi Cement (Amsons Group) | Financially resilient operator with a strong balance sheet, established brand equity, and a regional export footprint across East Africa. |

| East African Portland Cement | Legacy producer with significant installed capacity, constrained by restructuring challenges and operational inefficiencies. |

| Mombasa Cement | Cost-competitive coastal producer benefiting from proximity to clinker import routes and port-linked logistics advantages. |

| Savannah Cement | Grinding-focused player highly sensitive to clinker imports, foreign exchange movements, and shipping costs. |

| National Cement (Devki Group) | Fully integrated manufacturer pursuing aggressive expansion, captive power investments, and regional market penetration. |

From a market analysis perspective, National Cement and Bamburi Cement currently exert the greatest influence on Kenya’s cement supply and demand, driven by scale, vertical integration, and distribution control. Grinding-only producers remain structurally exposed to cement shortages in Kenya during periods of currency pressure or import disruptions.

Africa-Wide Cement Industry Context

Top cement manufacturers in Africa increasingly adopt vertical integration strategies to stabilise margins and manage volatility. These strategies include captive power generation, in-house clinker production, control of limestone quarries, and ownership of logistics. Major African cement groups such as Dangote Cement, Lafarge Africa, and Heidelberg Materials Africa have already demonstrated the effectiveness of this model.

Kenyan cement producers now align closely with this continental playbook. Rising energy costs, environmental compliance requirements, and logistics bottlenecks push manufacturers toward self-sufficiency and operational efficiency. This shift directly influences cement price forecast scenarios for Kenya 2026, as integrated producers gain greater pricing power during supply disruptions.

Further Reading: Top 10 Cement Brands in Africa Powering the Infrastructure Boom

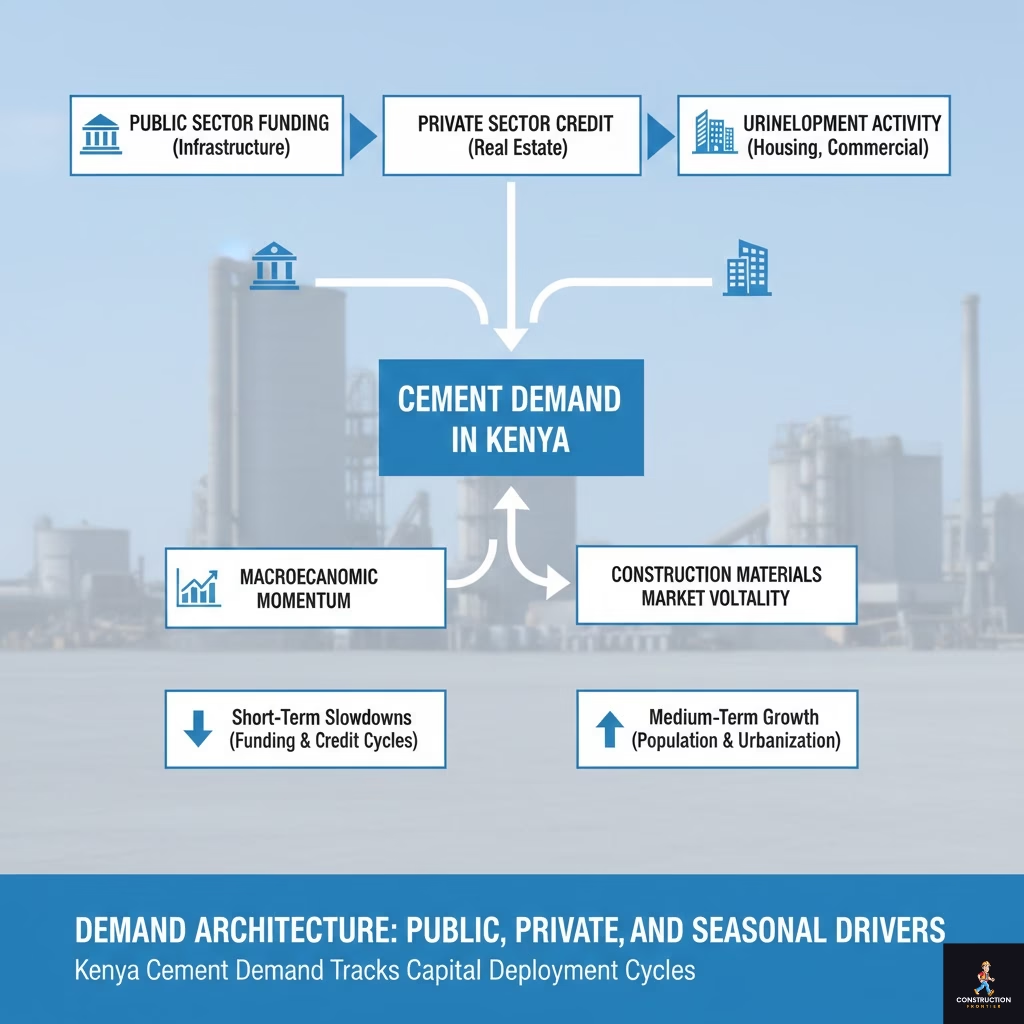

Demand Architecture: Public, Private, and Seasonal Drivers

Kenya cement supply and demand dynamics reflect macroeconomic momentum rather than structural overcapacity. The Kenya cement market expands and contracts in direct response to public infrastructure funding cycles, private sector credit availability, and urban development activity. When government disbursements slow or financing conditions tighten, cement off-take declines sharply, even when installed capacity remains unchanged.

This sensitivity explains the volatility observed across the Kenyan construction materials market. Cement demand does not follow a smooth growth curve; instead, it tracks capital deployment decisions. As a result, short-term slowdowns often mask the underlying strength of the cement industry in Kenya, while rapid recoveries occur once stalled projects resume execution.

Several structural factors continue to underpin medium and long-term demand across the Kenya cement market, supporting a resilient consumption outlook beyond cyclical fluctuations.

1. Public Infrastructure as a Volume Anchor

Affordable Housing Programmes remain a major driver, particularly in Nairobi, Mombasa, and fast-growing satellite towns such as Machakos, Thika, and Nakuru. These developments rely heavily on cement-intensive construction systems, reinforcing baseline demand even during periods of broader market uncertainty.

Transport, port, and energy infrastructure expansion also play a critical role, as seen in the Nairobi-Mombasa SGR project. Ongoing and planned investments in highways, bypasses, logistics corridors, power transmission, and port upgrades sustain large-volume cement consumption over extended project timelines. These projects anchor demand within the Kenyan construction materials market and stabilise off-take for major producers.

2. Private Sector Consumption Dynamics

Industrial parks and special economic zones further support cement demand through warehouse construction, factory floors, and utility infrastructure. As Kenya positions itself as a regional manufacturing and logistics hub, developments such as the Tatu City Logistics Park are expected to increase structural cement consumption beyond residential construction.

Private commercial and residential development, driven by urbanisation and population growth, continues to provide incremental demand. Although this segment responds more quickly to interest rate changes and credit conditions, it remains a long-term growth pillar for the Kenyan cement market.

According to data from the Kenya National Bureau of Statistics, long-term cement demand growth averages approximately 4%–6% per year, assuming stable macroeconomic conditions, consistent infrastructure funding, and manageable inflation. These fundamentals support a constructive outlook for Kenya’s cement supply and demand beyond short-term volatility.

3. Supply Constraints Affecting Cement Availability

Despite sufficient installed capacity on paper, adequate cement supply in Kenya remains constrained by structural production and operational factors. These constraints limit manufacturers’ ability to respond quickly to demand recoveries, contributing directly to cement shortages in Kenya.

- High capital expenditure requirements: Kiln upgrades and routine maintenance restrict output flexibility, particularly among older plants. Cement manufacturing assets require continuous reinvestment to maintain efficiency, control emissions, and reduce energy intensity. When financial pressure delays these investments, production reliability suffers.

- Rising environmental compliance: Producers face increasing requirements related to emissions controls, alternative fuel adoption, and environmental monitoring. While these investments improve long-term sustainability, they raise near-term operating costs and limit rapid capacity ramp-up within the cement industry in Kenya.

- Grid electricity reliability challenges: Frequent outages and tariff increases push manufacturers toward costly backup power solutions, increasing production costs and reducing operational stability. During periods of high demand, these energy constraints limit effective output and tighten market supply.

When macroeconomic conditions improve and demand rebounds, supply growth often lags consumption recovery. This imbalance intensifies cement shortages in Kenya and amplifies regional price volatility. Contractors and developers now treat cement supply risk as a core cost and scheduling variable, integrating it into procurement strategies, contract pricing, and project sequencing decisions.

Kenya Cement Market vs Regional Market Comparison

Placing the Kenya cement market in a regional context exposes why pricing behaviour, supply risks, and margin structures differ sharply across East Africa. While Kenya operates within a relatively liberalised and competitive cement industry, neighbouring markets benefit from structural cost advantages that insulate them from some of the price volatility observed in Kenya. These differences stem primarily from clinker self-sufficiency, energy input structures, and inland logistics efficiency.

Understanding these contrasts helps contractors, financiers, and policymakers assess whether current building materials prices in Kenya reflect temporary market stress or embedded structural costs.

Kenya vs Tanzania

Tanzania’s cement industry benefits from higher clinker self-sufficiency, which materially stabilises its production cost base. Major Tanzanian producers operate integrated plants near limestone deposits, reducing reliance on imported clinker and shielding the market from foreign-exchange volatility. This structural advantage allows Tanzanian cement prices to remain comparatively stable even during periods of regional currency pressure.

By contrast, the Kenya cement market continues to experience periodic clinker supply constraints, especially when domestic kilns undergo maintenance or capacity utilisation tightens. During such periods, producers rely on imported clinker through Mombasa, immediately exposing cement prices in Kenya to exchange rate movements, port handling charges, and maritime freight costs. These factors translate directly into higher ex-factory and delivered cement prices.

Logistics further widens the gap. Kenya’s central cement plants cluster near the coast and Athi River, but demand growth increasingly concentrates inland. Longer haul distances to western and northern markets raise per-tonne transport costs, intensifying price dispersion across regions. As a result, Kenyan contractors often pay a higher delivered price than their Tanzanian counterparts, even when headline bag prices appear similar.

From a market structure perspective, this dynamic contributes to cement shortages in Kenya during demand spikes, while Tanzania absorbs demand fluctuations more smoothly due to vertically integrated supply chains.

Kenya vs Ethiopia

Ethiopia presents a different competitive benchmark. The country holds abundant limestone reserves and supports cement production with relatively lower energy costs, particularly where hydropower feeds industrial grids. These inputs give Ethiopian producers a structurally lower clinker production cost compared to Kenya, strengthening price competitiveness at the factory gate.

However, Ethiopia’s logistics environment offsets some of these advantages. Inland transport bottlenecks, limited road capacity, and regulatory controls slow cement distribution and restrict cross-border exports. Kenya’s distribution network, by contrast, operates with greater efficiency and market responsiveness, allowing faster delivery cycles and broader market reach.

Despite this logistical advantage, Kenya’s cost base remains higher due to electricity tariffs, fuel costs, and exposure to clinker imports. These factors raise building material prices in Kenya relative to Ethiopia, particularly during periods of currency depreciation or energy price increases.

This comparison underscores a key insight: Kenya’s cement industry competes effectively on distribution efficiency but must address upstream cost pressures to strengthen long-term competitiveness within the Kenyan construction materials market.

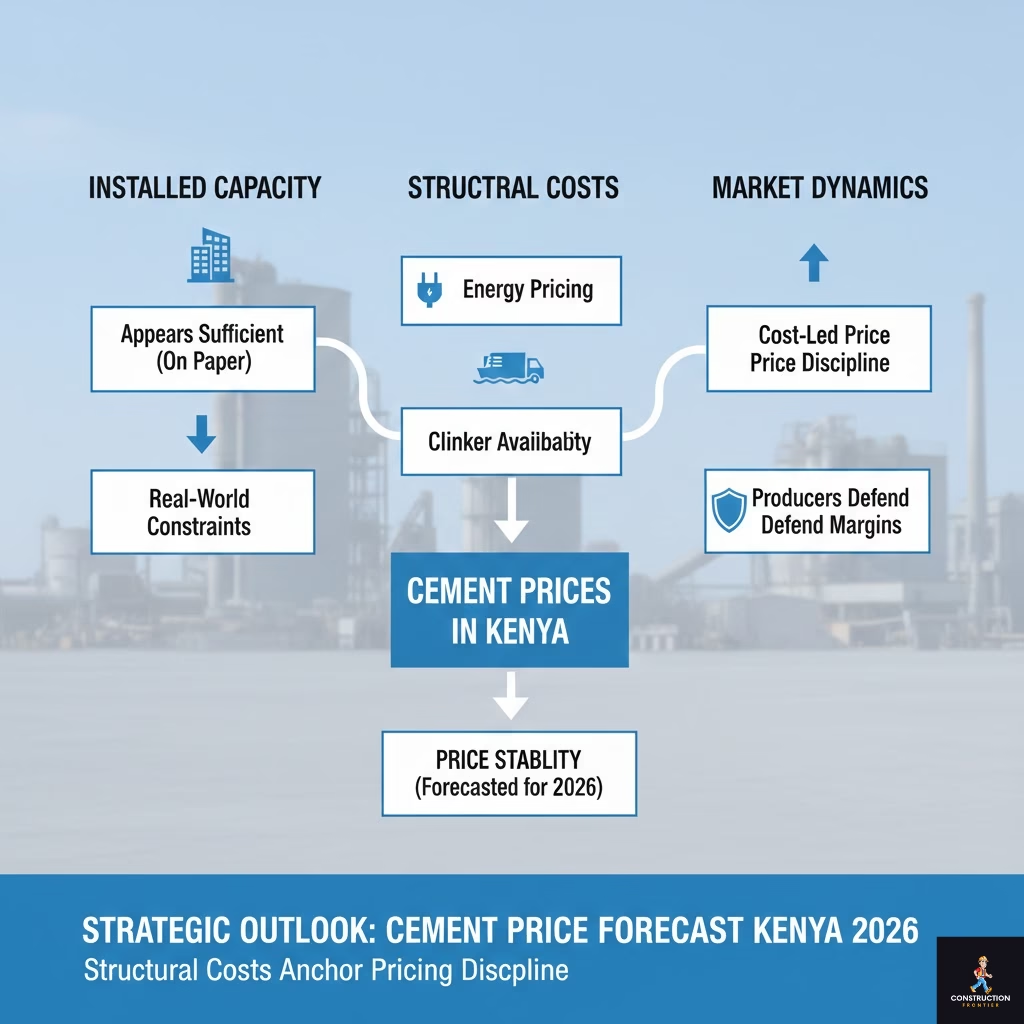

Strategic Outlook: Cement Price Forecast Kenya 2026

The cement price forecast for Kenya 2026 points toward price stability anchored by structural costs rather than surplus-driven price declines. While installed capacity appears sufficient on paper, real-world constraints in energy pricing, clinker availability, and logistics prevent aggressive downward price movements across the Kenyan cement market.

Rather than cyclical spikes and collapses, the market increasingly exhibits cost-led price discipline, with producers defending margins against rising input costs.

Price Trajectory Outlook

Cement prices in Kenya are unlikely to decline sharply through 2026. Producers face persistent cost pressures from electricity tariffs, fuel inputs, maintenance capital expenditure, and inland distribution costs. Even in periods of softer demand, these factors establish a firm price floor.

Moderate infrastructure execution in 2025 and early 2026 supports stable volume off-take, allowing producers to maintain utilisation rates without triggering price wars. As a result, Kenya cement market pricing trends point toward gradual, controlled adjustments rather than abrupt volatility.

For contractors and developers, this environment underscores the need to treat cement as a strategic input, not a commodity subject to sudden discounting.

Supply Stability Expectations

Supply conditions are expected to improve incrementally as new clinker capacity enters the market. Ongoing investments by leading producers such as Devki Group aim to reduce reliance on imported clinker, which historically amplified cement shortages in Kenya during demand surges.

However, capacity additions alone will not eliminate supply risk. Grid reliability, kiln downtime, and environmental compliance costs continue to constrain effective output. Supply stability will therefore improve gradually rather than immediately, reinforcing disciplined pricing behaviour across the cement industry in Kenya.

Demand Growth Projections

Demand fundamentals remain intact. Urbanisation, population growth, and continued public sector investment in transport, housing, and utilities sustain baseline consumption growth. Even as private sector construction responds to interest rate conditions, public works provide a stabilising anchor for Kenya’s cement supply and demand.

This demand structure supports a constructive medium-term outlook for the Kenya cement market, with consumption growth absorbing new capacity without triggering oversupply.

Further Reading: Top 15 Green Building Materials: Sustainable Choices for a Better Future

Cement Price Forecast Kenya 2026–2030: Scenario Analysis

Forecasting the Kenya cement market beyond 2026 requires scenario-based analysis rather than single-point estimates. Structural cost drivers, policy decisions, and macroeconomic conditions interact in ways that produce divergent outcomes for cement prices and supply reliability in Kenya.

Base Case Scenario (Most Likely)

Assumptions

- GDP growth averages 5%–6%.

- Energy tariffs remain stable in real terms.

- Infrastructure rollout progresses steadily.

Outcome

- Cement prices rise by 3%–5% annually.

- Supply remains broadly adequate, with occasional regional shortages.

- The impact of cement shortages on construction in Kenya remains manageable through forward procurement.

This scenario reflects the most probable trajectory for the Kenyan construction materials market under current policy and investment conditions.

Upside Scenario (Investment Acceleration)

Assumptions

- Lower interest rates stimulate private construction.

- Faster public infrastructure disbursement.

- New clinker capacity ramps up efficiently.

Outcome

- Improved supply stability reduces price volatility.

- Slower cement price growth despite higher volumes.

- Higher capacity utilisation strengthens producer balance sheets.

In this scenario, improved cost absorption benefits both producers and contractors without triggering excessive price inflation.

Downside Scenario (Cost Shock)

Assumptions

- Energy tariff hikes.

- Shilling depreciation increases import costs.

- Infrastructure funding delays.

Outcome

- Cement shortages in Kenya intensify.

- Cement prices spike above inflation.

- Project delays and cost overruns are increasing across the construction sector.

This downside case highlights why procurement planning and price hedging remain critical for large-scale projects.

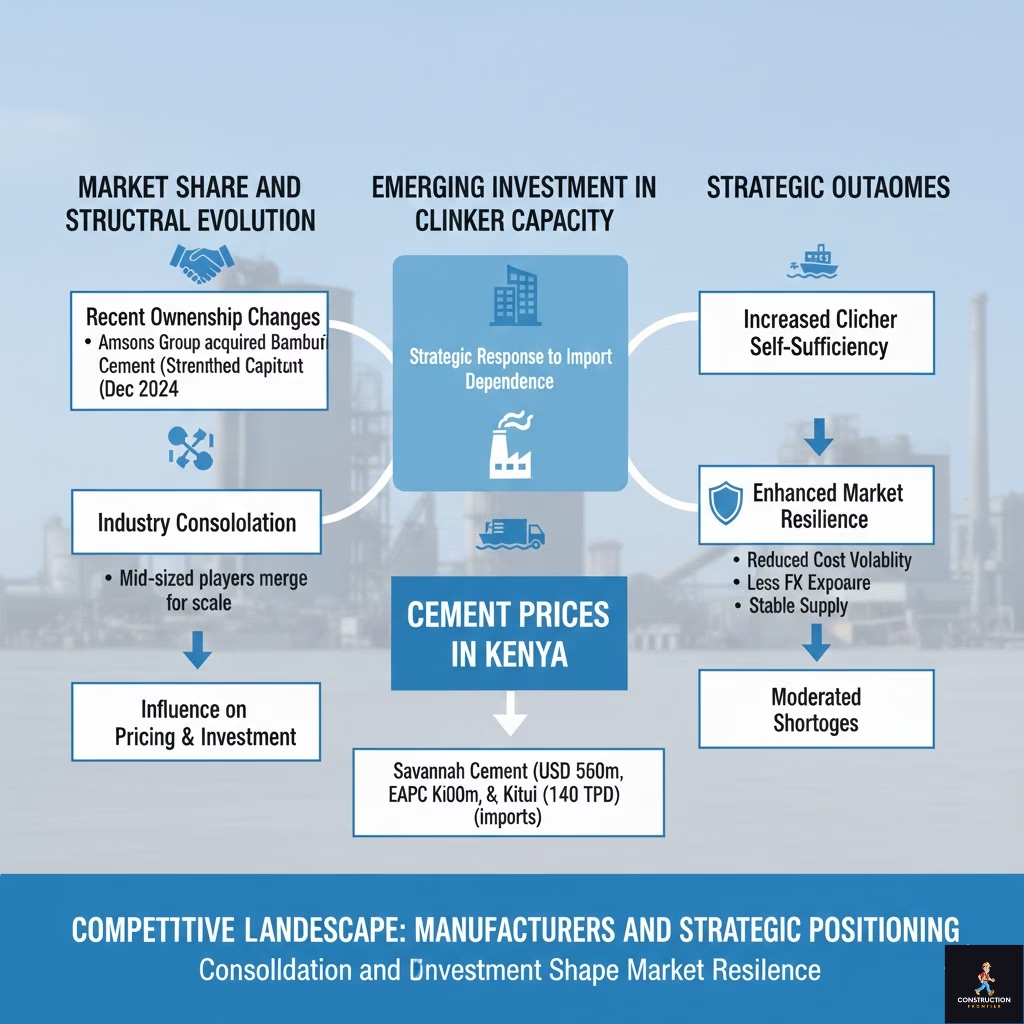

Competitive Landscape: Manufacturers and Strategic Positioning

The Kenya cement market features a dynamic competitive landscape shaped by consolidation, capital restructuring, and renewed investment in clinker capacity. Strategic positioning increasingly favours producers with integrated supply chains and strong balance sheets.

Market Share and Structural Evolution

Recent ownership changes, including Amsons Group’s acquisition of a 96.54% stake in Bamburi Cement in December 2024, signal a broader industrial realignment. These transactions aim to strengthen capital structures, improve operational efficiency, and secure long-term clinker supply. Consolidation among mid-sized players further underscores the need to achieve scale in Kenya’s cost-intensive cement industry.

These shifts influence competitive behaviour, pricing discipline, and long-term investment planning across the market.

Emerging Investment in Clinker Capacity

Planned clinker projects by Savannah Cement, valued at USD 500m in Kitui County, and East African Portland Cement kiln upgrades to 1400 tonnes per day represent a strategic response to chronic import dependence. By expanding domestic clinker production, these investments directly address cost volatility, foreign exchange exposure, and supply risk.

Over the medium term, increased clinker self-sufficiency will enhance the resilience of the Kenya cement market, support supply stability, and moderate the severity of cement shortages in Kenya during peak demand cycles.

Conclusion: Where the Kenya Cement Market Stands and Where It’s Headed

The Kenya cement market has evolved into a structurally complex, cost-driven market where pricing reflects energy, logistics, Forex exposure, and demand cycles more than capacity expansion alone. Short-term supply fluctuations arise from distribution bottlenecks and kiln availability, not fundamental scarcity.

From a strategic perspective, industry leaders should anticipate stable, cost-anchored pricing through 2026, gradual reductions in clinker import exposure, and demand growth closely tied to infrastructure execution and private-sector recovery. For contractors, developers, financiers, and engineers, this understanding provides the foundation for procurement planning, project costing, and risk management in Kenya’s construction economy.

Call to Action: Navigate Construction Markets with Authority

Stay ahead of materials pricing, supply risks, and infrastructure market shifts. Explore deeper, data-driven analysis on ConstructionFrontier.com. Build with insight, not assumptions, and shape competitive strategy with clarity.